US inbound tax solutions for foreign investors and businesses with US activities

Inbound Tax Services

Empowering You U.S. Journey: Customized Solutions, Seamless Compliance

Aligning Values with Actions: Collaborative and Proactive Tax Solutions Tailored to You

U.S. Inbound Tax Planning

US Outbound Tax Planning involves strategic initiatives to enhance investments and business expansions to the U.S., minimizing tax obligations while maximizing profitability. Our experienced team of Tax Planning Specialists has been crafting personalized strategies for individuals and corporations venturing into the U.S. market for over three decades.

U.S. Inbound Tax Preparation

As a premier global CPA firm, we are renowned for our excellence in delivering thorough US Inbound Tax Preparation services. Trusted by a large and diverse clientele, we specialize in preparing income tax returns. Our expert team meticulously ensures compliance with local and global tax regulations, guiding you through the intricate landscape of US tax requirements for inbound activities.

U.S. Inbound IRS Tax Representation

As a trusted leader tax advisor, we specialize in providing comprehensive US Inbound IRS Tax Representation services. With a track record of successfully representing clients in IRS audits and tax disputes, we offer expert guidance and strategic representation to navigate the complexities of US tax laws. You can trust us to protect your rights and achieve favorable outcomes during IRS audits and inquiries.

Why H&CO U.S. Inbound Tax Services??

Discover why H&CO Inbound Tax services stand out as the preferred choice for foreign investors, businesses, and individuals navigating US tax regulations. With a legacy of over 30 years in delivering exceptional expertise in inbound taxation, we are renowned as a leading US CPA firm specializing in inbound tax matters. Our consistent commitment to excellence is reflected in the trust of over 20,000 loyal international clients, highlighting our dedication to ensuring seamless compliance with US tax laws for inbound activities.

Our International Tax Advisors are here to help if you're considering relocating to, investing in, or establishing operations in the US.

Our Comprehensive U.S. Inbound Tax Services:

Table of Contents

U.S. Inbound Tax Planning and Compliance

Our U.S. Inbound Tax Planning service is designed to empower foreign investors with tailored strategies that not only ensure compliance with U.S. tax laws but also maximize tax benefits. We understand the complexities of entering the U.S. market and provide comprehensive planning to optimize tax outcomes, giving you peace of mind and confidence in your investment strategy. Our approach includes proactive tax planning to anticipate and address potential tax challenges.

Read more

Income Tax Preparation for Foreign Investors & Foreign Subsidiaries

Our professional Income Tax Preparation services ensure accuracy and compliance for foreign investors and international businesses. We handle all aspects of tax preparation, leaving you free to concentrate on your business operations without the stress of tax season. With our expertise, tax season becomes a streamlined process with minimized risks of errors or audits, saving you time and effort. Additionally, we offer proactive tax planning strategies to optimize deductions and credits, maximizing your tax savings.

Read more

Entity Structure Selection for Foreign Investors in the U.S.

Choosing the right business entity is crucial for foreign investors entering the U.S. Our expert advisors analyze your unique circumstances to recommend the optimal structure that minimizes tax liabilities and protects your assets. With our guidance, you can navigate the intricacies of U.S. tax laws with confidence and focus on growing your business successfully. We also provide ongoing support to adapt your entity structure as your business evolves, ensuring continued tax efficiency.

Read more

U.S. Pre-Immigration Tax Planning

Moving to the U.S. involves complex tax considerations. Our Pre-Immigration Tax Planning service helps you navigate these challenges by developing strategic tax plans tailored to your pre-arrival and post-arrival scenarios. We ensure that you're well-prepared for the tax implications of your move, allowing you to focus on settling into your new life and endeavors in the U.S. with confidence. Our services extend to ongoing tax compliance support, ensuring that you stay on track with your tax obligations after moving to the U.S.

Read more

Tax Optimization for Foreigners Investing in US Real Estate

Investing in U.S. real estate offers great opportunities but also comes with tax complexities. Our Tax Optimization for Real Estate Investments service is designed to maximize your returns while minimizing tax burdens. We implement customized tax strategies that align with your investment goals, ensuring that you make the most out of your real estate ventures and achieve optimal financial results. Our experts stay updated on changing tax laws and market trends to provide proactive advice for long-term success.

U.S. Branch Profits Tax & Exceptions for Foreign Corporation Advisory

Managing U.S. branch profit taxes requires expertise and attention to detail. Our advisory and compliance services cover all aspects of branch profit tax obligations for foreign businesses, ensuring accurate reporting and compliance with IRS regulations. With our support, you can navigate complex tax requirements confidently and avoid costly penalties, ensuring smooth operations and financial stability. We also provide training and ongoing support to your finance team to enhance internal tax compliance capabilities.

Permanent Establishment (PE) Tax Services

Understanding the implications of establishing a permanent establishment (PE) in the U.S. is critical for foreign entities. Our PE Analysis service provides thorough assessments of PE risks and tax implications, allowing you to make informed decisions and mitigate potential tax exposures effectively. With our guidance, you can navigate PE considerations with confidence and optimize your tax position. We also provide guidance on structuring business activities to minimize PE risks while maximizing operational efficiency.

The Closer Connection Exception to the Substantial Presence Test, Form 8840

Non-resident aliens seeking closer connection exception status with the IRS can rely on our expertise for seamless compliance. We assist in preparing and filing the necessary documentation, ensuring that you meet IRS requirements and maintain compliant tax status in the U.S. Our services simplify the process, saving you time and effort while ensuring regulatory compliance. Additionally, we provide ongoing monitoring and updates on tax law changes that may affect your closer connection status.

US Estate & Gift Tax Planning for Non-US Residents with US Assets

Estate and gift tax planning can be daunting, especially for non-U.S. residents with assets in the U.S. Our specialized service provides comprehensive planning to minimize tax liabilities and ensure smooth estate transitions. Whether you're planning for the future or dealing with immediate concerns, we offer solutions that protect your wealth and legacy while providing peace of mind. We also provide guidance on charitable giving strategies to further optimize your tax and estate planning goals.

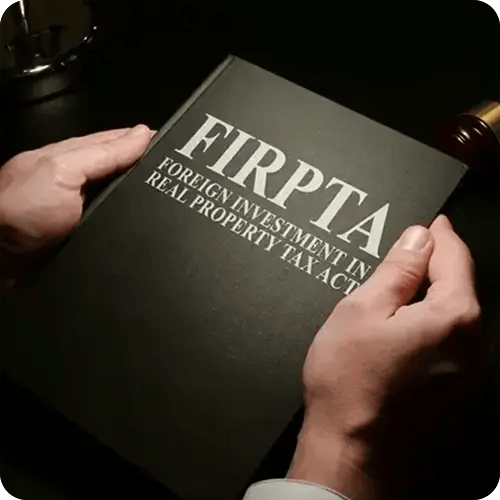

FIRPTA Withholding Certificates Application

Our FIRPTA Withholding Certificates Application service streamlines the process for foreign investors involved in real estate transactions subject to FIRPTA withholding. We handle the application process efficiently, allowing you to navigate FIRPTA regulations with ease and optimize your real estate investments. With our support, you can ensure compliance and maximize returns on your real estate ventures effectively. We also provide guidance on FIRPTA exemptions and strategies to minimize withholding tax obligations.

Tax Withholding Tax Compliance Services for Foreign Investors

Withholding tax obligations can significantly impact your bottom line. Our comprehensive planning and compliance services help you navigate withholding tax requirements, minimize tax liabilities, and ensure accurate reporting. We keep you updated with the latest regulations, allowing you to focus on your business operations without tax-related worries. Additionally, we conduct periodic reviews and audits to identify areas for improvement and implement proactive strategies to optimize your withholding tax management.

Treaty-Based Return Reporting Disclosure, Form 8833

Leveraging treaty-based return positions requires strategic planning and accurate disclosure. Our service ensures that you fully comply with IRS disclosure requirements while optimizing tax outcomes under tax treaties. We help you navigate complex treaty provisions and maximize tax benefits within the legal framework. Our experts stay updated on treaty developments and interpretive guidance, providing you with informed advice for maximizing treaty benefits and minimizing tax risks.

Certificate of Foreign Person’s Claim That Income Is Effectively Connected - W-8ECI

Claiming income effectively connected with U.S. trade or business requires proper documentation. Our service assists foreign persons in obtaining the necessary certificates, ensuring compliance with IRS regulations and avoiding tax-related issues. We provide guidance on documenting income sources, maintaining proper records, and meeting IRS documentation requirements for effective connection claims. Our expertise ensures that you can substantiate your income claims confidently and avoid potential tax challenges.

Transfer Pricing Services for US Inbound & US Outbound Operations

Effective transfer pricing is crucial for multinational businesses operating in the U.S. Our service optimizes transfer pricing strategies to align with IRS regulations, minimize tax risks, and enhance overall profitability. We help you navigate transfer pricing complexities with confidence, ensuring compliance and tax efficiency. Our experts conduct transfer pricing studies, implement inter company agreements, and provide documentation to support your transfer pricing positions, ensuring that you can defend your pricing strategies during IRS audits.

U.S. Inbound IRS Tax Audit Representation

Our U.S. Inbound IRS Tax Audit Representation service provides expert guidance and representation during IRS audits for foreign investors and businesses operating in the U.S. We ensure compliance with IRS regulations, handle communication with tax authorities, and develop strategies to minimize tax liabilities and penalties. With our comprehensive audit representation, you can have peace of mind and focus on your business operations while we handle the IRS audit process efficiently and effectively.

15 Most Common IRS Tax Forms Related to U.S. Inbound Tax Compliance

-

Form 1040-NR: U.S. Nonresident Alien Income Tax Return. Nonresident aliens who have U.S. income or are engaged in a U.S. trade or business file this form.

-

Form 1042-S: Foreign Person's U.S. Source Income Subject to Withholding

-

Form 1120-F is the U.S. Income Tax Return of a Foreign Corporation. It is used by foreign corporations that are engaged in a trade or business within the United States

-

Form 5472: Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business. Required for reporting transactions between foreign-owned U.S. corporations and their foreign owners or related parties.

-

Form 8833: Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b). Used to disclose treaty-based return positions.

-

Form 8832: Entity Classification Election. Used by eligible entities to elect their classification for federal tax purposes.

-

Form 8825: Rental Real Estate Income and Expenses of a Partnership or an S Corporation. Partnerships and S corporations use this form to report rental income and expenses from real estate holdings.

-

Form 8840: Filed by individuals who are considered "closer connection" to a foreign country than to the United States for purposes of determining their residency status.

-

Form 4562: Depreciation and Amortization. Investors use this form to claim depreciation deductions on their real estate assets over their useful lives.

-

Form 4797: Sales of Business Property. Used to report gains or losses from the sale of real estate held for investment or used in a trade or business.

-

Form 8288: U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests. Foreign investors selling U.S. real property interests are subject to withholding tax, and this form is used to report and remit the withholding amount to the IRS.

-

Form W-9: Request for Taxpayer Identification Number and Certification. Used to request the taxpayer identification number (TIN) of a U.S. person.

-

Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals). Used by non-U.S. individuals to claim treaty benefits or establish foreign status for tax withholding purposes.

-

Form W-8BEN-E: Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities). Similar to W-8BEN but for entities.

-

Form 1040-C: U.S. Departing Alien Income Tax Returns

Maximize Opportunities, Minimize Taxes – Navigate U.S. Inbound Taxation

Get started with tailored guidance today!