Form 8865: A complete Guide for U.S. Persons with Foreign Partnerships

Navigating the complexities of international tax compliance can be overwhelming, especially when it comes to owning or having interests in foreign...

10 min read

H&CO

Oct 14, 2024 11:00:39 AM

H&CO

Oct 14, 2024 11:00:39 AM

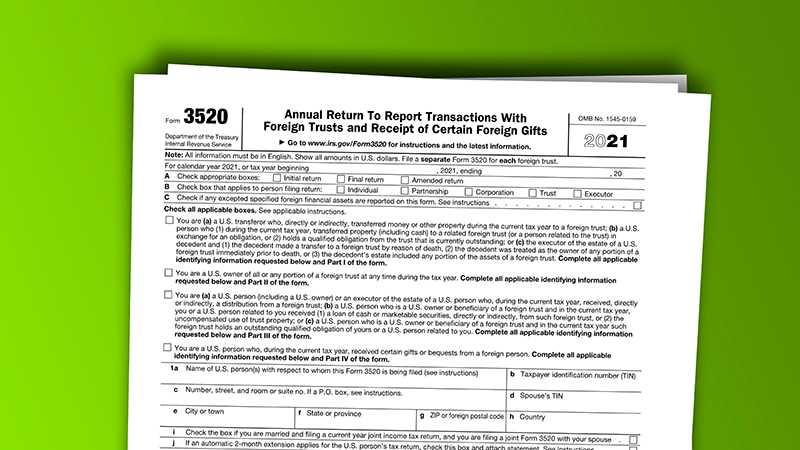

If you’ve received a gift from certain foreign persons, a foreign trust, or a foreign corporation, it’s crucial to understand IRS reporting requirements. Additionally, understanding the reporting requirements is vital if you have foreign financial accounts. Failing to comply with these regulations can lead to significant penalties. Proper disclosure of foreign gifts and trust transactions is key to avoiding such penalties. This guide explains the steps for filing Form 3520, including reporting thresholds, necessary information, and relevant rules to help you remain compliant with the law.

Index

|

Key Takeaways

|

U.S. persons receiving gifts from foreign individuals, estates, corporations, partnerships, or foreign financial institutions must report these gifts on Form 3520 if they exceed certain thresholds—$100,000 from foreign individuals or estates and specific amounts from foreign corporations or partnerships. This reporting ensures compliance with IRS regulations, as foreign gifts are not typically taxable but must be disclosed to avoid penalties. Accurate and timely filing of Form 3520 is crucial for U.S. taxpayers to maintain transparency and avoid significant fines.

A foreign trust is any trust that does not meet both the “court test” and the “control test” as defined under Section 7701(a)(30)(E) of the Internal Revenue Code.

Court Test: This test requires that a court within the United States must have the authority to exercise primary supervision over the administration of the trust. This means that the trust’s administration must be subject to the jurisdiction of a U.S. court, which can oversee and direct the trust’s operations and activities.

Control Test: This test mandates that one or more U.S. persons must have the authority to control all substantial decisions of the trust. Substantial decisions include critical aspects such as:

If a trust fails either the court test or the control test, it is classified as a foreign trust. This classification typically applies to trusts established outside of the United States or those where non-U.S. persons hold control over the trust’s substantial decisions. For instance, if the trust is administered under the jurisdiction of a foreign court or if non-U.S. persons have the authority to make significant decisions, the trust would be considered foreign. Foreign trust compliance is crucial to ensure adherence to relevant regulations and avoid potential penalties. A foreign grantor trust is a specific type of foreign trust where the grantor retains certain powers or benefits.

A foreign gift is any property transferred without full consideration (i.e., no expectation of return). The IRS characterizes a gift by the absence of a quid pro quo. Common types of foreign gifts include:

Transfers from Foreign Individuals: Gifts received from individuals who are not U.S. residents or citizens. This can include monetary gifts, real estate, personal property, or other assets.

Bequests from Foreign Estates: Inheritances received from the estates of deceased foreign individuals. These can include cash, investments, real property, and personal belongings. When U.S. persons receive distributions or transfer assets to a foreign estate, they must adhere to specific tax implications and reporting rules, including filing IRS forms to avoid penalties for non-compliance.

Gifts from Foreign Corporations: Transfers from foreign corporations to U.S. persons. These might include financial gifts, shares, or other corporate assets given without an equivalent exchange of value.

Gifts from Foreign Partnerships: Transfers from foreign partnerships, which could involve cash, partnership interests, or other property given without compensation.

Gifts from Other Foreign Entities: This can include transfers from foreign trusts, foundations, or other entities. The IRS treats these as gifts if they are made without the expectation of an equivalent return.

In essence, a foreign gift is defined by the absence of a quid pro quo transaction. The recipient does not provide goods, services, or any form of compensation in exchange for the gift. This broad definition ensures that various forms of transfers from foreign sources are captured under IRS reporting requirements to maintain tax compliance and transparency in international financial transactions. It is crucial to understand the importance of foreign gift tax reporting to avoid potential penalties and ensure compliance with IRS regulations.

U.S. taxpayers are required to report foreign gifts received from foreign persons or foreign financial institutions to the IRS using Form 3520, “Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.” U.S. taxpayers, including citizens, resident aliens, and domestic trusts.

U.S. taxpayers, including citizens, resident aliens, and domestic trusts, who receive certain foreign gifts or engage in transactions with foreign trusts, must adhere to foreign gift reporting requirements and file Form 3520. This form ensures that all qualifying transactions are reported for tax compliance. This includes any foreign financial accounts that may be associated with foreign gifts or trusts.

Transfers to foreign trusts: This includes the name of the trust’s creator, the date of the trust, and the country where the trust was created.

Ownership of foreign trusts: U.S. owners must report the value of trust assets they own.

Distributions from foreign trusts: Details such as the date of distribution, description of the property distributed, and its fair market value must be provided.

Receipt of foreign gifts or bequests: Reporting includes gifts from foreign individuals, foreign estates, foreign partnerships, or foreign corporations. If gifts are received from a foreign partnership, the entity’s name, address, and U.S. tax ID number (if available) must be provided. Proper foreign gift documentation is essential to ensure compliance.

Foreign financial assets: Details of any foreign financial assets associated with the foreign gifts or trusts.

Penalties for failure to report are calculated as a percentage of the gross value of unreported items.

1. Reporting Transfers to Foreign Trusts (Part I)

U.S. persons who transfer property to foreign trusts must disclose:

The trust creator (name and identifying information)

The date and value of the transfer

Additionally, under Treasury Regulations, a ‘qualified obligation’ must be in writing, have a term not exceeding five years, require payments to be in U.S. dollars, and meet specific reporting requirements on Form 3520.

This section applies to U.S. persons transferring property or executors transferring assets to foreign trusts due to death. This includes any transactions involving foreign financial institutions.

2. Reporting Ownership of Foreign Trusts (Part II)

If you own any part of a foreign trust, you must report this ownership even if there were no transactions during the year. The trust must also file Form 3520-A, or you must file a substitute Form 3520-A to avoid penalties.

3. Reporting Distributions from Foreign Trusts (Part III)

U.S. persons who receive a distribution, loan, or uncompensated use of foreign trust property must report the transaction. This includes reporting details such as the value of the property or loan.

4. Reporting Receipt of Foreign Gifts (Part IV)

U.S. persons must report foreign gifts exceeding:

$100,000 from nonresident individuals or estates.

Foreign corporate gifts exceed the section 6039F threshold.

Form 3520 must be filed by U.S. persons on the 15th day of the 4th month following the end of their tax year for income tax purposes. For most individuals, this typically means the form is due by April 15th. However, if the U.S. person is granted an extension of time to file their income tax return, the deadline for filing Form 3520 is extended as well. In such cases, the form is due no later than the 15th day of the 10th month following the end of the tax year, which usually falls on October 15th. Ensure that any foreign financial accounts are also reported within the same timeframe.

Taxpayers must be aware of these deadlines to avoid penalties for late filing. Extensions for filing income tax returns automatically extend the deadline for Form 3520, but taxpayers must ensure they file within the extended period. Properly tracking these dates and coordinating with tax preparers can help ensure timely submission. Accurate and timely filing of Form 3520 is essential to remain compliant with IRS regulations and avoid any potential financial penalties.

Section 6677 outlines penalties for late filing or incomplete submissions:

$10,000 or up to 35% of the gift’s value for failure to report.

5% of trust assets owned by a U.S. person if the trust fails to file Form 3520-A.

Penalties escalate if non-compliance persists beyond 90 days after receiving an IRS notice. However, penalties will not exceed the gross reportable amount. Penalties can also apply to unreported foreign financial assets.

The IRS provides relief from penalties if the taxpayer can demonstrate that their failure to comply was due to reasonable cause and not due to willful neglect. Taxpayers must provide evidence that their failure to file Form 3520 or to provide complete and correct information was beyond their control and that they took steps to comply with the tax laws as soon as they were able. This relief is designed to ensure that taxpayers are not unduly penalized for circumstances beyond their control. This can include issues with foreign financial institutions that were beyond the taxpayer's control.

Demonstrating reasonable cause typically involves showing that significant unforeseen events or circumstances prevented timely compliance. This might include natural disasters, serious illness, or reliance on incorrect professional advice. To seek relief, taxpayers must submit a detailed explanation and supporting documentation when requested by the IRS. Successfully demonstrating reasonable cause can exempt taxpayers from penalties, thus, it is important to maintain thorough records and documentation of any such circumstances.

Form 3520 and Form 3520-A serve distinct yet complementary roles in the realm of IRS reporting requirements for foreign trusts. Form 3520 is typically filed by a U.S. taxpayer to report specific events such as the creation of a foreign trust, the receipt of certain distributions from a foreign trust, or the receipt of substantial gifts from foreign persons. This form is event-driven and usually filed once to account for a particular transaction or series of transactions that occur within a tax year. In contrast, Form 3520-A requires annual filing and provides a comprehensive report on the activities, income, and distributions of a foreign grantor trust with U.S. taxpayer beneficiaries, thereby charting the ongoing financial journey of the trust. Both forms may require details of foreign financial accounts associated with the foreign trusts or gifts.

The responsibility for these forms falls on different parties. Form 3520 is completed by the U.S. beneficiary, recipient, or owner of the trust, whereas Form 3520-A is the responsibility of the trustee of the foreign grantor trust. A notable distinction is that Form 3520-A necessitates the use of an Employer Identification Number (EIN) for the foreign trust, instead of the U.S. owner’s Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This distinction is critical for maintaining clarity and compliance in IRS records. If the foreign trust fails to file Form 3520-A, the U.S. owner must step in and file a substitute Form 3520-A along with Form 3520, ensuring that compliance is maintained despite potential international complications.

Understand Filing Requirements: Be sure of your filing obligations and thresholds for foreign gifts and trust transactions.

Gather Information: Have detailed records of transfers, gifts, and foreign trust dealings.

Track Foreign Gifts: Maintain clear documentation of all foreign gifts or transfers.

File Timely: Ensure Form 3520 is submitted on time (April 15th or October 15th if an extension is granted).

Use Professional Assistance: Consider consulting a tax professional for complex foreign transactions.

Understand Penalties: Be aware of the substantial penalties for non-compliance, but also of the reasonable cause relief provisions.

Review IRS Guidelines: Regularly check IRS updates for any changes to reporting requirements.

Report Foreign Financial Assets: Ensure that all foreign financial assets are accurately reported.

At H&CO, our team of seasoned tax professionals understands the complexities surrounding Form 3520 and the reporting of foreign trusts and gifts. With a personalized and detail-oriented approach, we provide expert guidance to help you navigate both U.S. and international tax laws, ensuring compliance while minimizing your tax liability. Our team stays current on all changes to tax regulations, ensuring that you benefit from the latest available deductions and credits. Our team can also assist with reporting foreign financial accounts associated with foreign gifts or trusts.

For over 30 years, our bilingual International Tax Advisors have offered outstanding tax services to individuals, families, real estate investors, family offices, small businesses, multinationals, and foreign individuals. We are committed to providing tailored solutions that address your specific tax situation, ensuring that your obligations are met efficiently and effectively.

With offices in the US in Miami, Coral Gables, Aventura, Fort Lauderdale, Orlando, Melbourne, and Tampa as well as offices in over 29 countries, our CPAs and International Tax Advisors are readily available to assist you with all your income tax planning, tax preparation and IRS representation needs. To learn more about our accounting firm services, take a look at our individual tax services, business tax services, international tax services, expatriate tax services, SAP Business One, entity management, human capital, and audit and assurance services.

Form 3520 is used by U.S. persons to report transactions with foreign trusts and the receipt of certain foreign gifts. This form ensures that the Internal Revenue Service (IRS) is aware of foreign assets and distributions, helping to maintain compliance with U.S. tax laws. This includes reporting any foreign financial assets associated with the foreign gifts or trusts.

Failing to file Form 3520 or filing it incorrectly can result in significant penalties from the IRS. These penalties can include fines based on the value of the foreign asset or distribution, which emphasizes the importance of timely and accurate reporting. This can include transactions involving foreign financial institutions.

Yes, you must report a foreign inheritance to the IRS using Form 3520 if it exceeds certain thresholds. This ensures compliance with U.S. tax laws regarding foreign assets and helps the IRS monitor substantial transfers from foreign persons. Ensure that any foreign financial accounts associated with the inheritance are also reported.

You can receive up to $100,000 from a foreign trust or foreign entity as a gift before needing to report it to the IRS using Form 3520. Gifts from foreign corporations or foreign partnerships have lower reporting thresholds. This includes any foreign financial assets associated with the foreign trust.

A foreign trust involves a legal arrangement where a trustee manages assets for beneficiaries, while a foreign gift refers to a direct transfer of property or money without compensation. Both must be reported to the IRS on Form 3520 if they meet certain thresholds. Both may involve transactions with foreign financial institutions.

U.S. persons, including citizens, resident aliens, and certain domestic entities, must file Form 3520 if they engage in transactions with foreign trusts or receive certain foreign gifts. This includes direct or indirect distributions from foreign trusts. This includes any foreign financial accounts associated with the foreign gifts or trusts.

The reporting threshold for foreign gifts is $100,000 from a foreign person, foreign estate, or estate in a calendar year. For gifts from foreign corporations or foreign partnerships, the threshold is significantly lower, requiring careful tracking and reporting. Ensure that any foreign financial assets associated with the gifts are also reported.

Yes, the IRS imposes severe penalties for failing to file Form 3520 or for providing incomplete or incorrect information. Penalties can include substantial fines, underscoring the importance of accurate and timely reporting of foreign assets and distributions. Penalties can also apply to transactions involving foreign financial institutions.

While it is possible to file Form 3520 yourself, consulting a tax professional is advisable due to the complexity of reporting foreign trusts and foreign gifts. A professional can ensure compliance with IRS regulations and help avoid costly mistakes. A tax professional can also assist with reporting foreign financial accounts associated with foreign gifts or trusts.

The cost of filing Form 3520 varies depending on whether you use a tax professional and the complexity of your foreign assets and transactions. While the form itself has no filing fee, professional services can add to the cost, reflecting the intricate nature of international tax compliance. The complexity of foreign financial assets can also affect the cost of filing.

Navigating the complexities of international tax compliance can be overwhelming, especially when it comes to owning or having interests in foreign...

In today’s globalized economy, many U.S. persons find lucrative opportunities by investing in foreign corporations. However, with these international...

When investing abroad, U.S. taxpayers encounter numerous reporting obligations and tax challenges. One of the most complex forms associated with...