Form 8865: A complete Guide for U.S. Persons with Foreign Partnerships

Navigating the complexities of international tax compliance can be overwhelming, especially when it comes to owning or having interests in foreign...

12 min read

H&CO

Oct 14, 2024 12:07:28 PM

H&CO

Oct 14, 2024 12:07:28 PM

In today’s globalized economy, many U.S. persons find lucrative opportunities by investing in foreign corporations. However, with these international ventures come specific U.S. reporting obligations that must not be overlooked. One such critical requirement is the IRS Form 5471, officially titled the “Information Return of U.S. Persons concerning Certain Foreign Corporations.” This form plays a pivotal role in ensuring transparency and compliance with U.S. tax laws for individuals involved in foreign corporate activities. Additionally, compliance with Form 5471 can provide benefits such as the foreign tax credit.

In this article, we will explain in detail the specifics of IRS Form 5471, exploring who must file it, the information required, and the implications of non-compliance. Whether you are an experienced international investor or considering foreign corporate ventures, this guide will provide you with the essential knowledge to navigate the complexities of Form 5471 reporting.

INDEX

Form 5471, officially known as the “Information Return of U.S. Persons to Certain Foreign Corporations,” is a critical document for U.S. taxpayers involved with foreign corporations. This form requires U.S. taxpayers who are officers, directors, U.S. shareholders, or shareholders of certain foreign corporations to provide detailed information about their ownership and financial interests in these entities.

The 2017 tax reform increased the requirements for this form, asking for more detailed information and extending the filing obligation to a broader range of U.S. taxpayers. Not submitting a complete Form 5471 without reasonable cause can lead to substantial financial penalties each year.

The primary purpose of Form 5471 is to provide the IRS with comprehensive information about U.S. taxpayers who are officers, directors, or shareholders in certain foreign corporations. This form requires detailed reporting on the foreign corporation’s income, balance sheet, income statement, stock ownership, and other financial activities. By mandating this level of disclosure, the IRS can effectively monitor the international business operations and financial status of these foreign entities. Essentially, Form 5471 is a critical tool for preventing tax evasion and maintaining the integrity of the U.S. tax system. It ensures compliance with U.S. tax code sections 6038 and 6046, along with related regulations. One of the benefits of compliance with Form 5471 is the potential to claim the foreign tax credit.

U.S. persons, including individuals, corporations, partnerships, trusts, estates, and U.S. shareholders with controlled ownership in certain foreign corporations, must file Form 5471. This includes officers, directors, and shareholders, and considers both direct and constructive ownership. Even if the required schedules contain zero amounts, they must be completed and submitted. A separate Form 5471 and all relevant schedules are needed for each applicable foreign corporation. In general, you must file Form 5471 if you are:

A U.S. citizen or resident who is an officer or director of a foreign corporation experiencing significant ownership changes.

A U.S. shareholder owns at least 10% of the voting power or value of a foreign corporation, including through constructive ownership.

A U.S. shareholder in a Controlled Foreign Corporation (CFC), where U.S. shareholders collectively own more than 50% of the total combined voting power or value of the corporation.

A U.S. person, in general, and as defined by IRS Section 7701(a)(30), includes:

A citizen of the United States;

A resident of the US for tax purposes;

A domestic partnership;

A domestic corporation; or

An estate or trust that is not a foreign estate or trust, as defined in section 7701(a)(31).

A foreign corporation is any corporation incorporated outside the United States. A foreign corporation is any corporation that is not created or organized in the United States or under the laws of the United States, its states, or its territories. These entities operate under the jurisdiction of foreign laws and typically conduct business activities outside the United States. For U.S. tax purposes, foreign corporations are subject to different reporting and compliance requirements compared to domestic corporations, especially when owned and or controlled by U.S. persons.

Certain foreign corporations, particularly those that meet specific criteria, require detailed reporting to the IRS. These corporations include Controlled Foreign Corporations (CFCs), Passive Foreign Investment Companies (PFICs) that are also CFCs, and other foreign entities in which U.S. persons hold substantial ownership interests. In addition to CFCs, PFICs are also subject to extensive reporting requirements when they overlap with the CFC criteria. A PFIC is a foreign corporation that primarily earns passive income or holds assets that produce passive income. When a PFIC is also a CFC, the reporting becomes even more complex, as it must comply with the regulations governing both PFICs and CFCs.

A Controlled Foreign Corporation (CFC) is a foreign corporation in which more than 50% of the total combined voting power of all classes of stock entitled to vote or the total value of the stock is owned directly, indirectly, or constructively by U.S. shareholders on any day during the taxable year.

Ownership Threshold: To be classified as a CFC, U.S. shareholders must own more than 50% of the foreign corporation’s voting power or value.

U.S. Shareholders: To determine CFC status, a U.S. shareholder is defined as a U.S. person who owns at least 10% of the total combined voting power of all classes of stock entitled to vote or 10% of the total value of shares of the foreign corporation.

Direct, Indirect, and Constructive Ownership: Ownership can be direct (owned personally), indirect (owned through another entity), or constructive (attributed ownership through family members, partnerships, estates, trusts, or corporations).

Tax Tips: Ownership attribution rules are complex, and stock owned by related family members or entities can be attributed to you. Consult with a tax advisor to accurately calculate your ownership stake to avoid unintentional filing omissions.

Compliance with CFC rules is essential for several reasons. Compliance ensures that U.S. taxpayers adhere to tax regulations when conducting business operations or owning subsidiaries in a foreign country. First, it ensures adherence to U.S. tax laws, avoiding significant penalties for non-compliance. Second, it promotes transparency and prevents tax evasion by providing the IRS with detailed information about foreign corporations owned by U.S. persons. Third, it helps taxpayers avoid double taxation by claiming foreign tax credits and other relevant deductions. Non-compliance can lead to severe consequences, including hefty fines and legal repercussions. Compliance with Form 5471 also allows taxpayers to benefit from the foreign tax credit, which can reduce their overall tax liability.

Tax Tips: Taxpayers who file Form 5471 may be eligible to claim a foreign tax credit, which can help reduce U.S. tax liability by offsetting taxes paid to foreign governments. Always ensure that you claim this credit to avoid double taxation.

Accurately determining your category of filer for Form 5471 is crucial for several reasons. Each category has specific filing requirements, schedules, and statements that must be completed to ensure compliance with IRS regulations. Getting incorrectly your filer category can lead to incomplete or incorrect income tax filing, which can result in significant penalties and increased scrutiny from the IRS. Precise categorization helps avoid double reporting or omitting essential data. Getting the category of filer right on Form 5471 is essential to avoid penalties, ensure accurate and comprehensive reporting, and comply with IRS international tax regulations.

Here’s a detailed explanation of each category, highlighting the who, the purpose, and the filing requirements. The importance of understanding the different categories is that each category filer has to provide different types of information to the government.

The Who: U.S. shareholders of a foreign corporation that qualifies as a specified foreign corporation at any time during the corporation’s tax year, who owned the stock on the last day of that year and it relates to the transition tax.

The Purpose: To report ownership in foreign corporations affected by specified corporations, which deals with the transition tax on accumulated foreign earnings.

The Filing Requirement: U.S. shareholders must file Form 5471 and include detailed information about the foreign corporation, including income statements, balance sheets, and other financial data, ensuring compliance with Section 965 regulations, and transition tax.

The Who: U.S. citizens or residents who are officers or directors of a foreign corporation in which a U.S. person has acquired 10% or more interest in a foreign corporation. This category goes after officers and directors, not the shareholders. Please note that you do not have to be the owner of the corporation to fall within this category. If you are an officer or director of a foreign corporation and a US citizen or resident acquired 10% or more interest in the corporation, you are category 2.

The Purpose: The primary purpose of Category 2 is for the IRS to monitor significant ownership changes in foreign corporations by U.S. persons. When a U.S. person acquires or disposes of a substantial ownership interest (meeting the 10% stock ownership requirement), it triggers a reporting obligation. This helps the IRS keep track of whether U.S. investors are paying tax on those transactions.

The Filing Requirement: Officers or directors must file Form 5471 to report these ownership changes and provide necessary details about the acquisition and the foreign corporation’s financial information.

The Who: A U.S. person who either acquires enough stock in a foreign corporation to meet the 10% stock ownership requirement, a foreign person who becomes a U.S. person while holding at least 10% ownership in a foreign corporation, or a US person who sells enough stock to drop below the 10% ownership threshold. This category deals with the U.S. person who is an owner of a foreign corporation.

The Purpose: To track U.S. persons acquiring significant ownership in foreign corporations and ensure proper reporting of such acquisitions or disposals. This helps the IRS to track the reporting of investments and dispositions on foreign corporations. Since the IRS does not have jurisdiction over the foreign corporation, the burden of reporting is on the U.S. person.

The Filing Requirement: Filers must submit Form 5471 detailing the acquisition or disposal, including the percentage of ownership before and after the transaction and relevant financial information about the foreign corporation.

The Who: This category includes a U.S. person who had control of a foreign corporation during the annual accounting period of the foreign corporation. Control is defined as owning more than 50% of the total voting power or value of the corporation’s outstanding stock at any time during that U.S. person's tax year.

The Purpose: To report the activities of foreign corporations controlled by U.S. persons, ensuring transparency and compliance with U.S. tax regulations. The IRS wants to identify U.S. persons who have significant control over foreign corporations and monitors whether the foreign corporation's income is properly reported in the U.S.

Filing Requirement: Filers must provide extensive details on Form 5471, including the corporation’s financial status, income statements, balance sheets, and other necessary data to reflect their control and the corporation’s operations.

The Who: U.S. person who is a 10% or more U.S. shareholder in a foreign corporation that was a CFC at any time during the foreign corporation’s tax year ending with or within the U.S. shareholder’s tax year, and who owned that stock on the last day in that year in which the foreign corporation was a CFC. The CFC only counts 10% of US shareholders. If a U.S. shareholder owns less than 10%, he or she does not count.

The Purpose: To ensure proper reporting of U.S. ownership in CFCs, which are foreign corporations with significant U.S. shareholder presence, subjecting them to specific tax rules. This comprehensive reporting helps the IRS track international investments and enforce tax obligations on global income.

Filing Requirement: Filers must submit Form 5471 with detailed information about the CFC, including its earnings, profits, income statements, balance sheets, and other relevant financial data, to comply with CFC regulations.

Tax Tips: Different categories of filers have distinct reporting requirements, and filing under the wrong category can trigger penalties. Ensure you correctly identify your category—especially if you are a U.S. shareholder of a foreign corporation or an officer/director.

You should keep in mind that attributions rules apply when preparing form 5471. Attribution rules are essential for determining the ownership interests of U.S. persons in foreign corporations by including direct, indirect, and constructive ownership. These rules ensure that stock ownership held by related parties, such as family members or through entities like partnerships or trusts, is appropriately attributed to the taxpayer. The primary purpose of these rules is to prevent evasion of reporting requirements and ensure comprehensive and accurate reporting of all significant foreign ownership interests.

Tax Tips: Not all U.S. persons with foreign corporate interests need to file Form 5471. Review the exceptions carefully, such as dormant foreign corporations and certain treaty-based return positions, which could exempt you from filing obligations.

While many U.S. persons with interests in foreign corporations must file Form 5471, specific exceptions may apply. Understanding these exceptions is crucial for avoiding unnecessary filings and ensuring accurate reporting where required.

Here are some exemptions:

Constructive Ownership: Constructive ownership can influence these exceptions by attributing ownership from one person to another, potentially exempting some filers. For example, Category 1 filers who do not directly own an interest in the foreign corporation and are only required to file due to constructive ownership from another U.S. person may be exempt if the U.S. person through whom they constructively own an interest files all required information. Similarly, Category 3 filers who do not own a direct interest and are only required to file due to constructive ownership from a nonresident alien might also be exempt.

Dormant Foreign Corporations: Dormant foreign corporations can be exempt from filing Form 5471 under specific conditions. A foreign corporation is considered dormant if it has no significant financial activity during the tax year, such as income, expenses, or distributions.

Treaty-Based Return Positions: Certain taxpayers may rely on treaty-based return positions to claim exemptions from filing Form 5471. If a tax treaty between the U.S. and another country provides relief or exceptions that impact the reporting requirements of a foreign corporation, the taxpayer must disclose this position on Form 8833.

and other exemptions.

Form 5471 is typically due on the same date as the taxpayer’s income tax return, including any extensions. This means U.S. persons with interests in foreign corporations must ensure they file Form 5471 by the tax return deadline, usually April 15 for individuals, unless an extension is requested. The form should be attached to the taxpayer’s annual income tax return and filed with the IRS. Failure to file on time can result in significant penalties, making it crucial to adhere to these deadlines and submission guidelines.

Tax Tips: Ensure Form 5471 is filed on time. The IRS imposes a $10,000 penalty for each incomplete or late filing, with additional fines of up to $50,000 if the form remains unfiled after notice.

Failing to file Form 5471 or submitting an incomplete form can lead to severe penalties. The IRS imposes a penalty of $10,000 for each annual accounting period of the foreign corporation for which the form is not filed. If the IRS issues a notice and the form is still not submitted within 90 days, additional penalties of up to $50,000 can be levied. Moreover, non-compliance can trigger further scrutiny and audits from the IRS, potentially resulting in more fines and legal complications. It is therefore vital for taxpayers to understand their filing obligations and ensure timely and accurate submissions.

Anti-deferral provisions in the U.S. tax code are designed to ensure that U.S. taxpayers cannot indefinitely defer taxation on income earned through foreign corporations. These provisions target specific types of income to be included in current U.S. taxable income, preventing the deferral of U.S. tax liabilities. There are three main regimes under these provisions: Controlled Foreign Corporation (CFC) regime, Passive Foreign Investment Company (PFIC) regime, and Global Intangible Low-Taxed Income (GILTI) regime.

Subpart F Provisions: The CFC regime, detailed in Code §§951-964, also known as the "Subpart F" provisions, requires U.S. shareholders of CFCs to include certain types of income in their current taxable income. This includes foreign-based company income, insurance income, and passive income such as dividends, interest, rents, and royalties.

(PFIC) Passive Foreign Investment Company Regime: The PFIC regime, outlined in Code §§1291-1298, applies to foreign corporations that primarily generate passive income or hold passive assets. U.S. shareholders of PFICs must either include their share of the PFIC's income each year under the Qualified Electing Fund (QEF) regime or pay additional taxes and interest on distributions and gains under the excess distribution rules.

(GILTI) Global Intangible Low-Taxed Income Regime: The GILTI regime, established under USC §951A, targets the income of CFCs that exceeds a 10% return on tangible assets, known as the "deemed tangible income return." U.S. shareholders must include their share of GILTI in their current taxable income, ensuring that income from intangible assets, such as intellectual property, is taxed at a minimum rate. This regime aims to reduce the incentive for U.S. companies to shift profits to low-tax jurisdictions.

These anti-deferral regimes require U.S. taxpayers to include certain foreign income in their taxable income each year, regardless of whether the income is received. This prevents the use of foreign entities to defer U.S. taxes and ensures that the IRS can tax foreign income as it is earned.

Tax Tips: U.S. shareholders of CFCs may be subject to Subpart F income rules and Global Intangible Low-Taxed Income (GILTI) taxation. Be proactive in identifying these income streams to ensure compliance and avoid unexpected tax bills.

Navigating the complexities of Form 5471 and CFC regulations can be challenging without professional assistance. Seeking help from tax experts who specialize in international tax compliance can provide invaluable support. These professionals can help ensure all necessary forms and schedules are accurately completed and submitted on time, mitigating the risk of penalties. They can also offer strategic advice on managing foreign investments and complying with U.S. tax laws, ultimately helping taxpayers maintain compliance and avoid costly mistakes. Additionally, handling international tax matters requires expert knowledge to ensure accuracy and compliance, providing peace of mind to clients.

Tax Tips: The complexities of international tax reporting, including Form 5471, are best handled by experienced tax advisors. Avoid costly mistakes by seeking guidance from professionals who specialize in international tax compliance.

Compliance with Form 5471 and CFC regulations is essential for U.S. persons with interests in foreign corporations. Understanding the various categories of filers, filing requirements, and potential exceptions is critical to avoid penalties and ensure accurate reporting. While the process can be complex, especially for those with multiple foreign investments, seeking professional assistance can greatly simplify compliance and provide peace of mind. By adhering to IRS guidelines and leveraging expert help when needed, taxpayers can successfully navigate their international tax obligations and avoid the severe consequences of non-compliance.

At H&CO, our experienced team of tax professionals (CPAs) understands the complexities of income tax preparation and is dedicated to guiding you through the process. With excellent service and a personalized approach, we help you navigate US and international income tax laws, staying up to date with the latest changes.

For over 30 years, our bilingual trusted CPA International Tax Advisors have provided exceptional income tax services to individuals, families, real estate investors, family offices, small business owners, multinationals, and foreign individuals. Our goal is to ensure you take advantage of all available deductions and credits, minimizing your tax liability effectively.

With offices in the US in Miami, Coral Gables, Aventura, Fort Lauderdale, Orlando, Melbourne, and Tampa as well as offices in over 29 countries, our CPAs and International Tax Advisors are readily available to assist you with all your income tax planning, tax preparation and IRS representation needs. To learn more about our accounting firm services take a look at our individual tax services, business tax services, international tax services, expatriate tax services, SAP Business One, entity management, human capital and audit and assurance services.

Form 5471 includes the main portion where you report information about the filer and the foreign corporation. Additionally, various schedules may need to be completed, depending on your filing category. The schedules are:

Form 5471 - Information Return of U.S. Persons Concerning Certain Foreign Corporations

Form 5471 Schedule A – Stock of the Foreign Corporation

Form 5471 Schedule B – U.S. Shareholders of Foreign Corporations

Form 5471 Schedule C – Income Statement

Form 5471 Schedule E – Income, War Profits, and Excess Profits Taxes Paid or Accrued

Form 5471 Schedule F – Balance Sheet

Form 5471 Schedule G – Other information

Form 5471 Schedule H – Current earnings and profits

Form 5471 Schedule I – Summary of Shareholder’s Income from Foreign Corporation

Form 5471 Schedule J – Accumulated earnings and profits of Controlled Foreign Corporations

Form 5471 Schedule M – Transactions between controlled foreign corporation and shareholders or other related persons

Form 5471 Schedule O – Organization or reorganization of a foreign corporation, and acquisitions and dispositions of its stock (Part I to be completed by U.S. officers and directors, Part II to be completed by U.S. shareholders)

Navigating the complexities of international tax compliance can be overwhelming, especially when it comes to owning or having interests in foreign...

In today’s increasingly globalized business environment, U.S. investors and companies often hold ownership stakes in foreign corporations. The...

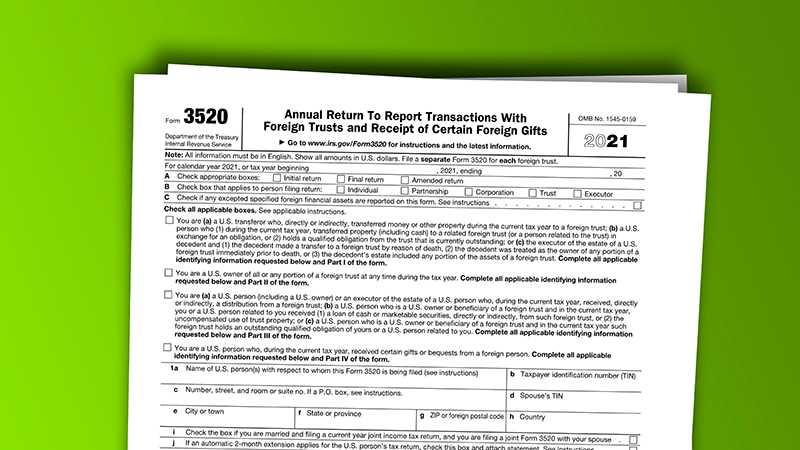

If you’ve received a gift from certain foreign persons, a foreign trust, or a foreign corporation, it’s crucial to understand IRS reporting...