Human Capital

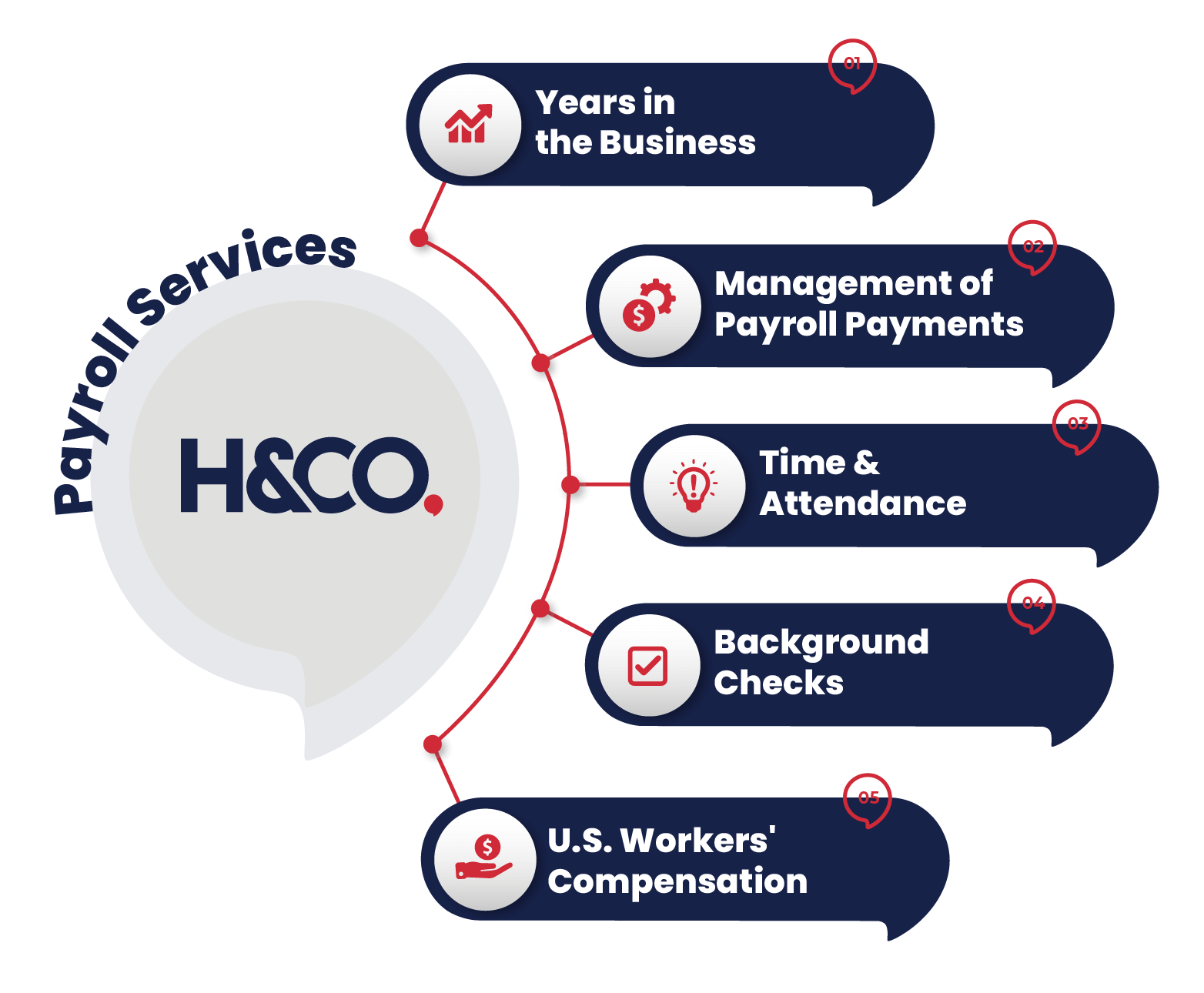

Payroll Services

Know the Payroll Service

It can be overwhelming to do payroll for all your employees; however, you should consult with your payroll and human resources advisor for the specifics of your situation.

Finding someone who is ready to address your concerns and needs can be difficult, but H&CO's payroll experts are distinguished by a Client Services culture that keeps them fully compliant

- Hire, pay, manage, and retain employees with confidence

- Create a productive workplace: on-site, remote, hybrid

- Stay compliant with changing laws and regulations

Pay Your Team

on Time

H&CO's small business solutions are customized for businesses with 1–30 employees to help you save time, cut costs & comply with government regulations.

We know that it is a challenge for small businesses to take them into consideration and provide them with the consulting they need.

That is why we decided to prioritize the concerns of our clients and those entrepreneurs who need to rely on the work of a third party to help them stay in compliance with the law and manage their company's payroll from anywhere in the United States.

Experience You Can Count On

We are a CPA firm with a strong presence in Florida, but we also handle payroll across the country. We have over 30 years of experience that guarantee our work. Whether you prefer to prepare payroll digitally, or by email, we've got you covered!

Background Checks

Performing background checks on a potential hire candidate for your company is essential to ensuring the safety of your company and your employees.

In this way, the process is summarized in 3 easy steps: first, you must select the service package you are looking for, then you will provide us with the full name of the person to do the background search and finally, we will send you by email the results of these investigations.

Join our current clients for quality Payroll Services

Here are our quick tips you should consider:

-

Hire an accountant

Having access to an in-house accountant or even an outside consultant accountant can free up even more time than a rush payroll software solution. The accountant can manage your payroll and taxes, keep your business up to date and comply with government regulations, and handle decisions about what types of software to use and how best to use them.

-

Use a managed payroll provider

Managed payroll services refer to outsourcing payroll processing to an outside provider. The idea is to completely eliminate payroll concerns and questions about how to streamline the process and leave it to experts to manage all aspects of it.

-

Use unified pay periods

If different types or categories of workers are paid at different times, it can unnecessarily complicate payroll. When choosing a payment program, it's best to select a unified solution that complies with state rules and can be applied to the entire workforce.

-

What a Payroll Policy should include

The payroll policy should make precise how a business complies with regulations, what guidelines employees can expect, and what laws govern the payroll department.

Could cover:- Defining a workweek

- Time, attendance, and how to log hours

- Break periods and rules (including whether breaks are paid or unpaid)

- Overtime eligibility and rates

- Pay periods

- Payroll deductions (mandatory and voluntary)

- Wage structure

- Recordkeeping (how long payroll records are kept according to state and federal rules).