Choosing Cash Basis or Accrual Accounting for Your Business

To help you choose between these concepts for your business, first understand their definitions and then consult your trusted CPA.

3 min read

H&CO

Feb 15, 2024 7:23:46 AM

H&CO

Feb 15, 2024 7:23:46 AM

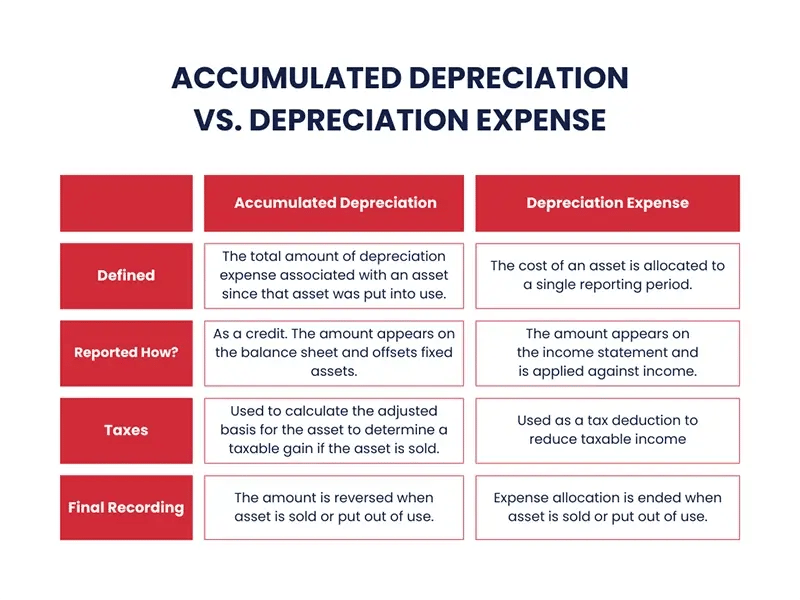

To put it simply, accumulated depreciation represents the overall amount of depreciation for a company's assets, while depreciation expense refers to the amount that has been depreciated in a specific period. Depreciation is an accounting entry that reflects the gradual reduction of an asset's cost over its useful life.

In simpler terms, depreciation spreads out the cost of an asset over its years of use, determining how much of the asset has been consumed in a given year, until the asset becomes obsolete or is no longer in use. Without depreciation, a company would have to bear the entire cost of an asset in the year of purchase, which could have a negative impact on profitability.

To put it another way, accumulated depreciation is the total amount of an asset's cost that has been allocated as depreciation expense since the asset was put into use.

| Table of Contents |

You might be interested in What Will the FASB's New Disclosure Rules Mean for Your Company?

The accumulated depreciation account is a contra-asset account on a company's balance sheet. It represents a negative balance, offsetting the gross amount of fixed assets reported. Accumulated depreciation indicates the total wear and tear an asset has experienced throughout its useful life.

Over time, the accumulated depreciation for an asset or group of assets will increase as depreciation expenses are recorded. When an asset is eventually sold or no longer in use, the accumulated depreciation associated with that asset will be reversed, removing all traces of the asset from the company's balance sheet.

You could read about 2024 Tax Filing Season: Official Dates

On the other hand, depreciation expenses represent the assigned portion of a company's fixed assets cost for a specific period. These expenses are recognized on the income statement as non-cash expenses that reduce the company's net income or profit. From an accounting standpoint, the depreciation expense is debited, while the accumulated depreciation is credited.

Depreciation expense is classified as a non-cash expense because the recurring monthly depreciation entry does not involve any cash transactions. As a result, the statement of cash flows, prepared using the indirect method, adds back the depreciation expense to calculate the cash flow from operations. Various methods, such as straight line, declining balance, sum-of-the-years' digits, and units of production, are used to calculate depreciation.

Tracking the depreciation expense of an asset is important for reporting purposes because it spreads the cost of the asset over the time it's in use.

The simplest way to calculate this expense is to use the straight-line method. The formula for this is (cost of asset minus salvage value) divided by useful life.

Say a company spent $70,000 for equipment for long-term use in its operations. It estimates that the salvage value will be $4,000 and the asset's useful life, 15 years. The depreciation expense per year would be $4,400.

($70,000 - $4,000)/15 = $4,400

Accumulated depreciation totals depreciation expense since the asset has been in use. Thus, after five years, accumulated depreciation would total $22,000.

$4,400 x 5 = $22,000

You could read about GAAP Accounting Principles Guide

Depreciation expense and accumulated depreciation are two important concepts in accounting that help companies accurately report the value of their assets over time. Here, we will outline the distinctions between depreciation expense and accumulated depreciation in various aspects that pertain to them.

You could read about What is a W9 Tax Form Used for?

Accumulated depreciation refers to the cumulative depreciation expense recorded for an asset on a company's balance sheet. It is determined by adding up the depreciation expense amounts for each year.

Accumulated depreciation is recorded in a contra-asset account, meaning it has a credit balance, reducing the fixed assets gross amount. As a result, it is not recorded as an asset or a liability.

Depreciation expense is recorded on the income statement as an expense and reflects the amount of an asset's value that has been consumed during the year. Therefore, it does not qualify as an asset or liability.

At H&CO, our experienced team of tax professionals understands the complexities of income tax preparation and is dedicated to guiding you through the process. With offices in Miami, Coral Gables, Aventura, Tampa, and Fort Lauderdale, our CPAs are readily available to assist you with all your income tax planning and tax preparation needs. To learn more about our accounting firm services take a look at our Individual tax services, business tax services, international tax services, expatriate tax services, SAP Business One, entity management, human capital, and audit and assurance services.

To help you choose between these concepts for your business, first understand their definitions and then consult your trusted CPA.

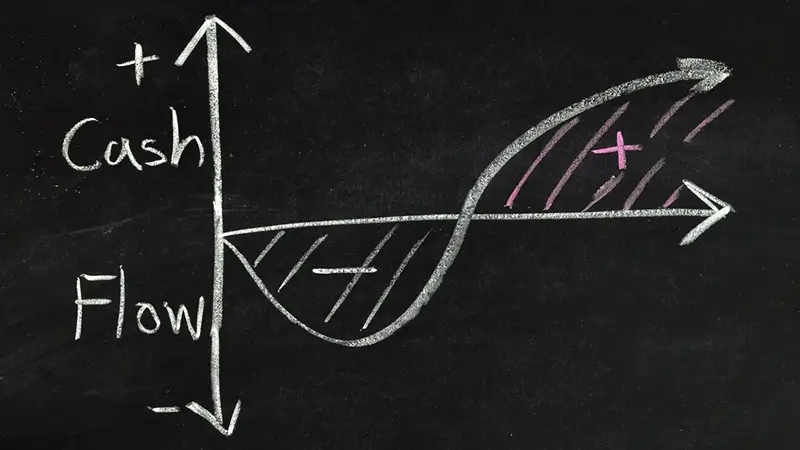

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

The Qualified Business Income (QBI) deduction, also known as the pass-through deduction or section 199A deduction, was established by the 2017 Tax...