Choosing Cash Basis or Accrual Accounting for Your Business

To help you choose between these concepts for your business, first understand their definitions and then consult your trusted CPA.

3 min read

H&CO

Mar 18, 2024 7:37:26 AM

H&CO

Mar 18, 2024 7:37:26 AM

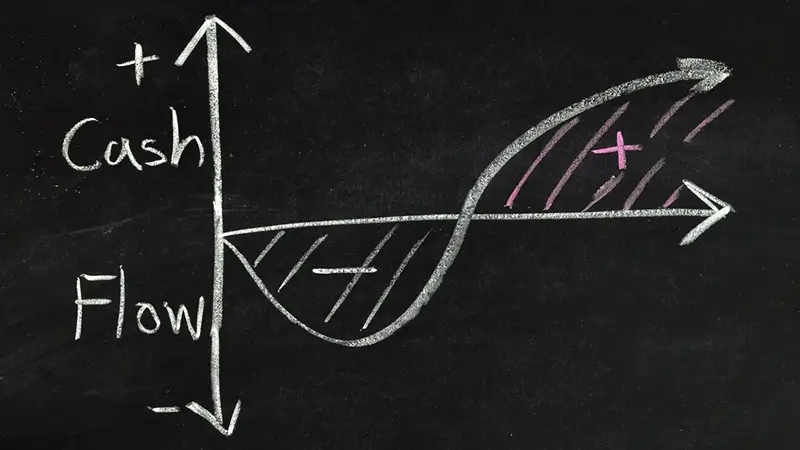

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your business. It serves as a means of closely monitoring the financial well-being of your business, ensuring that you have the necessary funds to operate and flourish.

| Key Takeaways |

|

Cash flow management is a continuous process that requires regular monitoring and adjustments. It is essential to consistently review your finances, adapt your strategies, and consider seeking professional assistance when necessary.

You may like Choosing Cash Basis or Accrual Accounting for Your Business

There are three prior areas in which cash can enter or exit your business: operating activities, investing activities, and financing activities.

Cash flow from operating activities refers to the cash flow generated from the day-to-day operations of your business. This includes the revenue generated from the sales of your products or services, as well as the expenses incurred in paying employee wages, suppliers, and income tax.

To illustrate, let's consider the example of owning a small bakery. Every donut sold and catering contract signed represents a positive cash flow into your business from operating activities. On the other hand, paying the company that supplies your flour represents a cash outflow from your business.

It's important to note that this outward flow of cash is not necessarily a negative thing. While it may sound cliché, you indeed need to spend money to make money. Hiring employees and paying suppliers are essential investments for the smooth functioning of your business. The key is to maintain a balance between these expenses and a consistent inflow of cash, ideally from both operating activities and the other types of cash flow.

Cash flow from investing activities can also include capital expenditures, commonly known as CapEx. These expenditures involve investing cash in physical, fixed assets, such as upgrading the electrical system in a warehouse you already own. It's important to note that while it may seem like an expense, it's an investment in your business's future. You expect this investment to yield dividends and contribute to the long-term growth and success of your business.

In contrast, operating expenses, also known as OpEx, represent short-term payments that are necessary to keep your business running smoothly on a day-to-day basis. These expenses are essential for maintaining the operational efficiency and effectiveness of your business.

Cash flow from financing activities refers to the funds you spend and earn to support your business. In simpler terms, it represents the money that moves between your business and the individuals or organizations that have invested in it, such as banks or shareholders. Key components of cash flow from financing activities include debt payments, stock issuance, and dividend payments to shareholders.

You may like What Will the FASB's New Disclosure Rules Mean for Your Company?

At H&CO, our experienced team of tax professionals understands the complexities of income tax preparation and is dedicated to guiding you through the process. With offices in Miami, Coral Gables, Aventura, Melbourne, Tampa, and Fort Lauderdale, our CPAs are readily available to assist you with all your income tax planning and tax preparation needs.

To learn more about our accounting firm services take a look at our individual tax services, business tax services, international tax services, expatriate tax services, SAP Business One, entity management, human capital, and audit and assurance services.

To help you choose between these concepts for your business, first understand their definitions and then consult your trusted CPA.

Understanding how to navigate the numbers in a company's financial statements is a crucial skill for stock investors. Analyzing and interpreting...

For global companies, matching intercompany transactions and pricing to the value created within their operations is key to both compliance and cost...