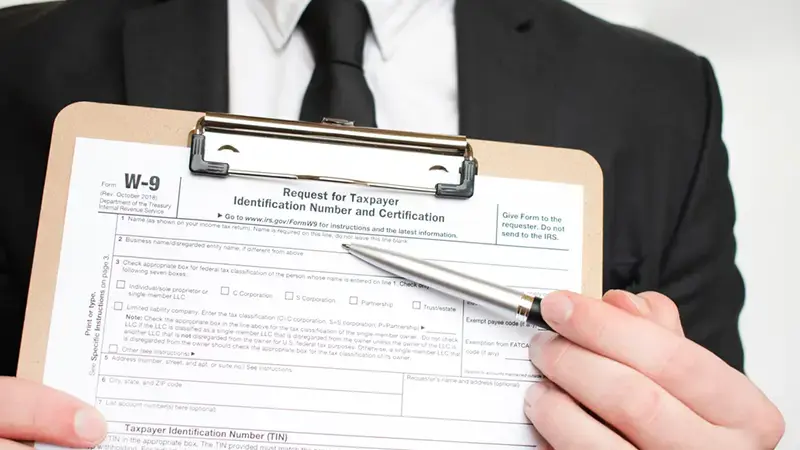

What is an IRS Form W9?

The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, gathers vital tax information from individuals or...

The BE-12 form is a tool used in the United States to collect data on foreign direct investments (FDI) in the country. It is a mandatory survey that must be completed by certain U.S. companies, both residents and non-residents, that have foreign investments or are owned by foreign investors.

The main purpose of the BE-12 form is to provide the United States government with detailed information about the economic activities of U.S. companies abroad. This includes data on the sales, assets, and earnings generated by these companies overseas. The form helps authorities monitor and understand the impact of foreign investments on the U.S. economy, as well as assess capital flows and the state of the balance of payments.

The BE-12 form is essential for collecting accurate and up-to-date information about the economic presence of U.S. companies abroad. This information is used by the government, economic analysts, and academics to evaluate trends and make informed decisions regarding trade, fiscal, and investment policies. In summary, the BE-12 form plays a fundamental role in collecting data on foreign direct investment in the United States and is a valuable tool for understanding the country's global economy.

The BE-12 form must be filed by certain U.S. companies, both residents and non-residents, that meet the criteria established by the U.S. Census Bureau. The main requirements are listed below:

Mandatory reporting companies: Companies that are subject to the mandatory filing of the BE-12 form include those that are directly or indirectly owned by foreign investors or have direct foreign investments abroad, and meet specific monetary thresholds established by the Census Bureau.

Non-U.S. companies: Non-U.S. companies operating in the United States that meet the established monetary thresholds must also file the BE-12 form.

It is important to note that the monetary thresholds and other requirements may vary depending on the reference date and the classification of the company based on its size and economic activity.

If a company meets the established criteria, it is generally expected to file the BE-12 form within the deadlines set by the Census Bureau. It is advisable to consult directly with the Census Bureau or seek legal or accounting advice to obtain specific and up-to-date information on the filing requirements of the BE-12 form in a particular context.

.webp?width=800&height=1422&name=Mail%20US%20BE-12_2%20(1).webp)

Our tax advisors have over 30 years of experience in income tax planning for high-net-worth individuals with significant income, business owners, investors, global families, and individuals with complex tax needs.

Contact us: BEA@hco.com

The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, gathers vital tax information from individuals or...

.webp)

While you may be well-acquainted with the traditional W-2 forms that provide details of your salary, it's important to keep up with the ever-evolving...

The Special Tax on Production and Services (IEPS) applies to the production and sale of certain goods and services in Mexico.If you're in Mexico,...