What Are the Financial Statements and How to Read Them?

Understanding how to navigate the numbers in a company's financial statements is a crucial skill for stock investors. Analyzing and interpreting...

Deferred revenue is a financial concept that refers to money that has been received by a company, but has not yet been earned. It is a liability on a company's balance sheet because the company is obligated to provide goods or services in the future in exchange for the money it has received. In other words, deferred revenue is revenue that is recognized on the balance sheet before it is earned.

When a company receives payment for goods or services that it has not yet delivered, it records the payment as deferred revenue on its balance sheet. This is because the company is obligated to deliver the goods or services in the future, and the payment represents a liability to the company until it has fulfilled its obligation. For example, a software company that sells annual subscriptions may receive payment for a year's worth of access to its software, but it has not yet provided all of the access that the customer has paid for. The company would record the payment as deferred revenue on its balance sheet until it has provided all of the access that the customer has paid for.

You may be interested in IRS Issues Standard Mileage Rates for 2023

In conclusion, deferred revenue is a liability on a company's balance sheet that represents money that has been received by the company but has not yet been earned. It is important to understand the concept of deferred revenue, as it can be a good indicator of a company's financial health and future revenue potential. Companies should be aware of the amount of deferred revenue they have on their balance sheet and how it is changing over time. It is also important to differentiate between deferred revenue and unearned revenue. Deferred revenue is money received and goods or services have been provided but revenue is not yet recognized while unearned revenue is money received but goods or services have not yet been provided.

Our CPAs have vast experience in international accounting helping people operate safely in their cross-border operations. Do not hesitate to request a consultation with us!

Understanding how to navigate the numbers in a company's financial statements is a crucial skill for stock investors. Analyzing and interpreting...

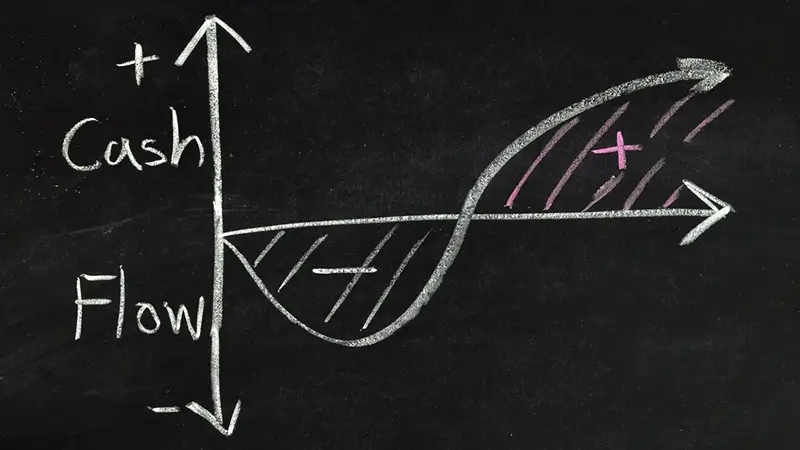

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

H&CO has been named on the Forbes list of America’s Best Tax and Accounting Firms 2023. This prestigious award is presented by Forbes and Statista...