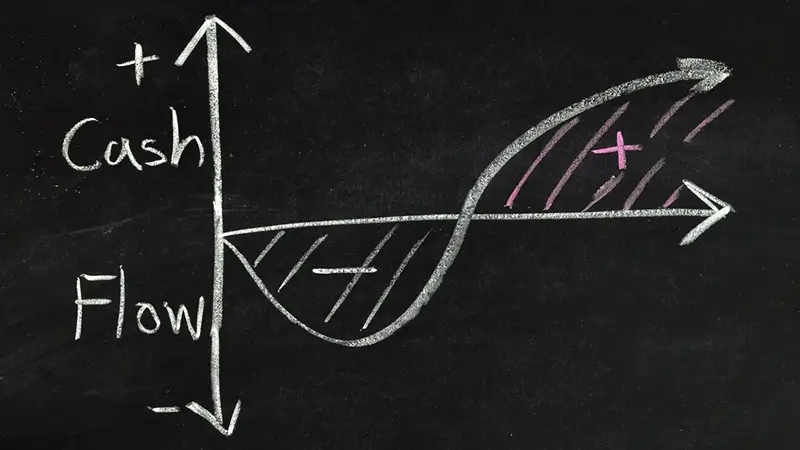

Cash Flow Management Explained: The Lifeblood of Your Business

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

As the covid-19 pandemic shifted the focus from cash to digital and contactless payment methods, more industries are now accepting cryptocurrency as a mode of payment.

As a result, 2021 has been an excellent year for blockchain technology. More companies dived into the industry, and people's interest in the industry skyrocketed. In addition, cryptocurrency found favor with governments and institutions exploring financial options beyond the traditional banking paradigm.

Consequently, higher levels of regulation and enforcement that can transform the industry have been introduced. With these changes, it's improbable that consumers and businesses that embraced crypto payment will look back even if the pandemic-related concerns recede. But even with these changes, what does the future hold for the cryptocurrency industry?

These changes in 2021 acted as a preview of what to expect in 2022 in the industry. From the groundwork, here are some crypto trends to expect in 2022.

In September this year, El Salvador became the first country to officially accept Bitcoin as a legal currency. Banco Bilbao Vizcaya Argentaria, the second-largest bank in Spain, enabled BTC trading and custody service to its private investors. With these monumental moments happening in 2021, it's most likely that the development will pave the way for more governments and financial institutions worldwide to accept crypto as a legal tender.

The merger of IoT and blockchain technology is a step towards creating intelligent machines' verifiable and secure data processing methods. With this integration, IoT devices across the internet will send data to private blockchain networks, creating tamper-resistant records of the shared transactions. Consequently, business partners will be able to share and access IoT data without the need for central control or management.

When the idea comes to life, it will benefit many businesses in numerous ways, including:

Many countries are working towards crypto mining to create their digital currencies to fend off threats posed by the existing cryptocurrencies. This comes after China leads the push among nations to adopt their own central bank-issued digital currency.

By actualizing the move, the countries will manage and control their digital currencies, hence avoiding the unregulated and decentralized nature of the existing crypto.

Latin America has been at the forefront in adopting cryptocurrency and is the home to El Salvador, the first country in the world to accept BTC as a legal tender. Investing in cryptocurrencies in the region is very lucrative as many countries here don't levy a crypto tax or any other capital gains.

Due to their relaxed approach to crypto classification, several cryptos are safe to invest in Latin America.

The crypto is an ideal BTC alternative, a decentralized software platform applicable for decentralized applications and smart contracts. Ethereum provides a suite of financial products freely accessible by anyone worldwide without the risk of fraud, control, downtime, or interference by a third party.

You can invest in this crypto to purchase other digital currencies through ether or develop and run your applications inside Ethereum. In 2021, Ethereum transitioned from a proof-of-work (PoW) algorithm to a proof-of-stake (PoS), which improved the network's transaction speed and improved the network security and processes.

DOT is a unique PoS that allows you to interoperate among other blockchains. The crypto will enable cryptos to work under the same roof giving you the freedom to connect across oracles, permissioned, and permissionless blockchains. In addition, it allows you to dive into crypto mining using the existing Polkadot's security.

Many see Dogecoin as the mother of memecoin after it caused a stir in 2021, and its price skyrocketed in 2021. Despite being relatively new in the crypto industry, many companies, including Dallas Mavericks, SpaceX, and Kronos, are already using it.

The crypto is a peer-of-stake that stands against other huge PoS cryptocurrencies in the industry, including Ethereum. It aims at becoming the world's best financial operating system by providing decentralized financial products and a chain of interoperability, voter fraud, and contract tracing.

Cryptocurrency is an alternative cash and credit card alternative that is taking the digital world by storm. Different cryptocurrencies are rising in value, making many people invest in them. In addition, they are backed up by blockchain technology which has a positive impact on e-wallets. That said, here are a few advantages of using crypto in the stock market.

Investing in crypto can be a lucrative investment as long as you're willing to accept the unpredictable risks such as losing it all. Before diving into investing, it's essential to acknowledge that the currency you choose could climb or drop in value at any moment.

In addition, make sure that you understand how your preferred crypto works and that it aligns with your long-term goals. If you need help making financial decisions and investing in crypto, don't hesitate to contact us.

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

.webp)

Income tax planning is a process that helps you reduce your tax liability by taking advantage of deductions and credits while timing income and...

No matter if your style is over the top or understated, nothing says who you are as much as your wristwatch. Some business titans wear a simple...