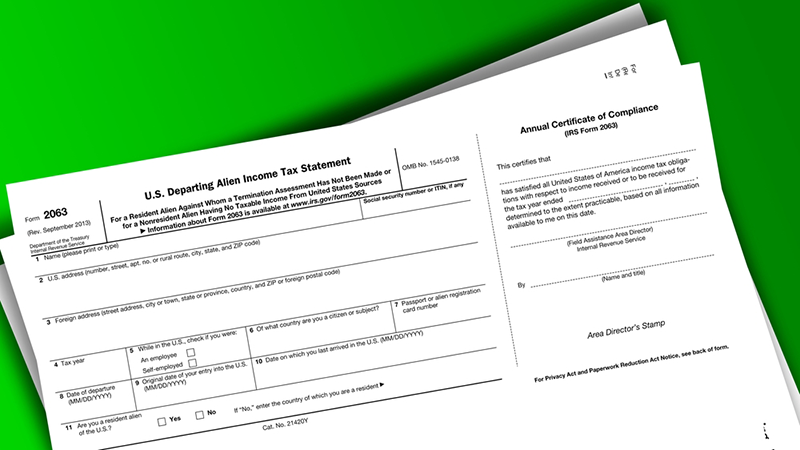

IRS Form 2063: U.S. Departing Alien Income Tax Statement

When leaving the United States, foreign nationals may face specific tax obligations depending on their residency status and income. One of the key...

The Department of the Treasury and the Internal Revenue Service on December 28, 2021 released final regulations on the foreign tax credit (FTC) for publication in the Federal Register. Additional final FTC regulations on other related subjects, such as the definition of financial services income and entity, the election to capitalize certain expenses in determining the tax book value of assets and the rules requiring the direct allocation of interest expense incurred by certain foreign banking branches have yet to be released.

The following provides a summary of some key takeaways from the 2021 final regulations.

The 2021 final regulations deny an FTC or deduction for foreign income taxes attributable to Internal Revenue Code (IRC) “Section 245A(d) income” of a domestic corporation (including a successor) or a foreign corporation, as well as “non-inclusion income” of a foreign corporation. Additionally, consistent with comments received regarding the lack of clarity in the 2020 proposed regulations, the 2021 final regulations removed references to “specified distributions” and “specified earnings and profits.”

“Section 245A(d) income” is defined in the 2021 final regulations as follows:

Additionally, “non-inclusion income” of a foreign corporation is defined as income other than subpart F income, tested income or items of income constituting post-1986 undistributed U.S. earnings.

In determining whether a service is an “electronically supplied service,” the 2021 final regulations state Treasury’s intent that services accessed by an end user outside of real time (asynchronously) will not constitute an “electronically supplied service” if, under all the facts and circumstances, the services primarily involve human effort. As a result, the 2021 final regulations remove the reference to “and synchronously” as clarification that the definition depends on the level of human effort rather than being rendered synchronously or asynchronously.

The 2020 proposed regulations introduced a “jurisdictional nexus” requirement for determining whether a foreign tax qualifies as a foreign income tax for purposes of IRC Sections 901 and 903 (“in-lieu-of” tax). As part of the 2021 final regulations, “jurisdictional nexus” was replaced with a new “attribution requirement” and incorporated into the existing net gain requirement to reflect that the rule limits the scope of gross receipts and costs attributable to a taxpayer’s activities and, thus, is appropriately included in the foreign tax base for other net gain requirement purposes. Under the “attribution requirement,” a foreign tax under IRC Sections 901 and 903 generally will not be creditable unless the foreign tax law requires sufficient nexus between the country and the taxpayer’s activities, and the “attribution requirement” continues to include activities-based, source-based and situs-based nexus rules. When foreign law and U.S. law characterize gross income or gross receipts differently, foreign law characterization will generally govern.

Treasury also provided clarification in the 2021 final regulations regarding the close connection test, as well as the jurisdiction-to-tax test, as part of the substitution requirement for an “in-lieu-of” tax.

The 2021 final regulations follow the 2020 proposed regulations for allocating and apportioning foreign income taxes on the following:

Consequently, under the 2020 proposed regulations, tax book value of assets will continue to be used for characterizing foreign gross income pursuant to a remittance, with some definitional changes.

The 2021 final regulations also incorporate the tested unit rules as part of the global intangible low-taxed income (GILTI) high-tax exclusion in lieu of the subpart F high-tax exception regulations (with conforming changes made to the GILTI high-tax exclusion regulations).

Moreover, the Treasury rejected comments requesting a delay in applicability dates; therefore, these rules apply to tax years beginning after December 31, 2019 and ending on or after November 2, 2020.

H&CO can help multinational taxpayers navigate these rules and regulations to ensure compliance and help identify opportunities to maximize benefits. Contact us for help!

When leaving the United States, foreign nationals may face specific tax obligations depending on their residency status and income. One of the key...

As the end of the year approaches, the IRS advises taxpayers to take early steps to prepare for the 2025 tax filing season. This advice is part of...

The U.S. Department of the Treasury and the Internal Revenue Service released final regulations on the foreign tax credit (FTC) on December 28, 2021....