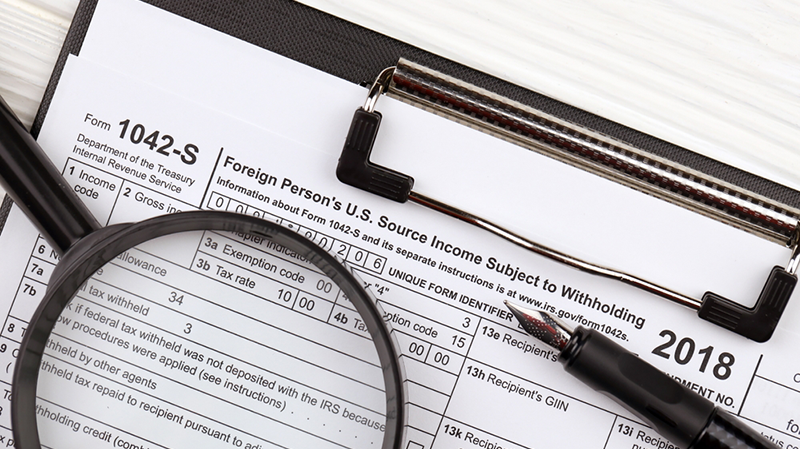

Form 1042-S: Foreign Person's U.S Source Income Subject to Withholding

When conducting business across borders or managing foreign investments in the United States, it’s crucial to understand the tax implications of...

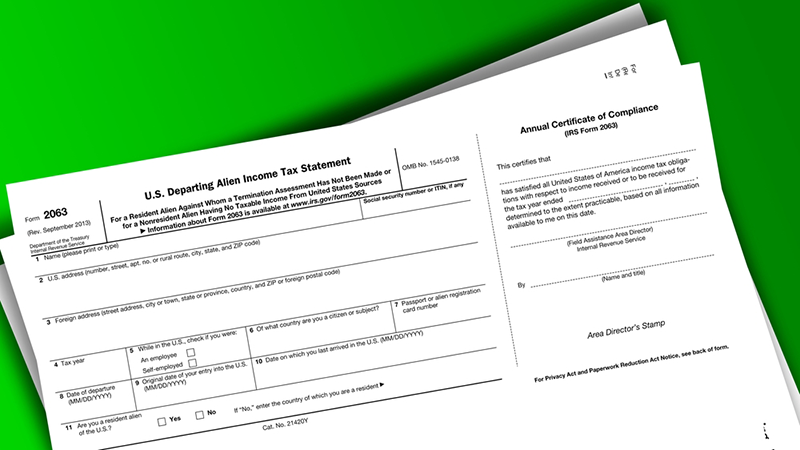

When leaving the United States, foreign nationals may face specific tax obligations depending on their residency status and income. One of the key forms relevant in this context is IRS Form 2063 – U.S. Departing Alien Income Tax Statement. While lesser known than Form 1040-C, Form 2063 serves a specific purpose for certain nonresidents and resident aliens planning to depart the U.S. Form 2063 is part of a broader set of procedures governed by U.S. immigration laws and enforced in coordination with agencies such as Homeland Security. The certificate of compliance required before leaving the United States is often referred to as a 'departure permit' or 'sailing permit,' and obtaining this permit ensures that travelers have met their income tax obligations prior to departure. This guide explains who should use it, when and where to file, and how to avoid common filing errors.

For more detailed information on tax obligations and procedures for departing aliens, refer to IRS Publication 519.

Form 2063 is a U.S. tax form issued by the Internal Revenue Service (IRS) that allows qualifying resident or nonresident aliens to depart the United States without needing to file Form 1040-C (U.S. Departing Alien Income Tax Return). The form acts as a statement to the IRS indicating that the departing individual does not owe any U.S. income taxes or will continue to file and pay taxes after departure.

An IRS agent usually issues this form after an interview and review of the taxpayer’s situation. Lawful permanent residents (green card holders) may have different requirements regarding Form 2063, as their tax and immigration obligations can differ from those of nonresident aliens. A border crossing identification card, proper identification, or other supporting documentation may also be required as part of the documentation reviewed during the departure interview.

Form 2063 is typically used by the following categories of departing aliens:

Resident or nonresident aliens who have no taxable income in the U.S. during the tax year of departure.

Aliens who do not plan to permanently leave the U.S. and will continue to comply with U.S. tax filing obligations (e.g., business travelers, temporary assignees).

Individuals with no U.S. tax liability and no income subject to withholding.

Certain students, trainees, or exchange visitors (F, J, M, or Q visa holders) who meet the IRS’s exemption criteria.

Individuals on a business trip with a B-1 or B-1/B-2 visa are generally exempt from the sailing permit requirement.

Individuals whose employment is authorized under U.S. immigration laws (employment authorized) are exempt from the sailing permit requirement.

Military trainees admitted for instruction under the Department of Defense (military trainee admitted) are typically exempt from Form 2063 requirements.

Those departing under official military travel orders are exempt from the sailing permit requirement.

Travelers departing under the visa waiver program have special status regarding departure documentation.

Tax Tips: Form 2063 is not filed directly by the taxpayer. Instead, it is prepared by an IRS official during the departure interview if the taxpayer meets eligibility criteria.

The purpose of Form 2063 is to certify that a departing individual has met or is not subject to U.S. tax obligations. Sailing permits, including Form 2063, are used by the IRS to ensure tax compliance before departure. The IRS uses Form 2063 to verify that all required income tax returns have been filed and that any tax paid is properly credited before departure. The form allows certain aliens to leave the U.S. without settling their tax liability immediately via Form 1040-C. It also serves as a compliance tool for the IRS to track foreign nationals who owe or may owe U.S. taxes.

For example, if an individual has no income or is exempt under a tax treaty, Form 2063 provides a faster alternative to the more complex Form 1040-C filing. Eligibility for Form 2063 is often determined based on the individual’s tax status for the preceding tax year.

Form 2063 is not self-filed but rather issued by the IRS during a departure interview. To obtain this form, schedule a departure interview at least 30 days before your planned departure date, if possible. The interview should be arranged at the local IRS office nearest to your place of employment or departure. Contact your local IRS office to make an appointment with an IRS Taxpayer Assistance Center (TAC).

Bring supporting documents such as:

Passport and visa

Permanent resident card (if applicable)

Copies of current and previous U.S. tax returns

Income statements (W-2, 1099)

Travel itinerary or airline tickets

Form I-94 (Arrival/Departure Record)

During the interview, you will be asked to provide information about your transportation line (such as the airline or other carrier you will use) and your planned departure date.

The IRS agent will assess your situation and determine whether you qualify for Form 2063 or must instead file Form 1040-C.

Common mistakes when dealing with Form 2063 include failing to schedule the departure interview early enough, since wait times can vary; missing your appointment may delay your exit. Another error is assuming that Form 2063 can be downloaded and filed independently; in reality, it must be issued by an IRS official during the interview process. Additionally, not bringing proper documentation—such as identification, prior tax returns, and income records—can result in delays or even a requirement to file Form 1040-C instead. Errors in tax computation or failure to pay the tax shown on IRS forms can also result in delays or denial of Form 2063. Lastly, ignoring prior tax obligations, including outstanding liabilities or unfiled returns, can disqualify you from eligibility to use Form 2063.

For foreign investors and business owners, understanding Form 2063 is especially important when:

You have income from U.S. sources (interest, dividends, real estate, or business activities).

You’re departing the U.S. but plan to maintain business ties or investments in the country.

You’re subject to withholding tax, income tax withholding, or effectively connected income (ECI).

If you have ongoing U.S. source income, you may also need to make estimated tax payments to the IRS to meet your tax obligations. In some cases, the IRS may require a bond agreement as a security measure to ensure compliance with tax obligations before departure.

In such cases, the IRS may determine that you must instead file Form 1040-C, particularly if there are complex income types, capital gains, or business expenses to consider.

Form 2063 and Form 1040-C serve different purposes for departing aliens, and understanding their distinctions is essential. Form 2063 is issued directly by the IRS and cannot be self-filed, while Form 1040-C must be filed by the taxpayer. Form 2063 certifies that the individual either has no U.S. tax liability or will not need to file a future return, making it suitable for students, short-term visitors, or those without U.S.-source income. In contrast, Form 1040-C is used to determine and settle a departing individual’s final U.S. tax liability, requiring the reporting of all taxable U.S. income and potentially the payment of estimated taxes. Taxpayers may be eligible to file a joint return with their spouse when using Form 1040-C, and married couples can file joint returns as part of the departure process. In some cases, the IRS may require a bond guaranteeing payment of any taxes owed before departure. Typically, Form 2063 does not involve a tax payment, whereas Form 1040-C often does.

No. Form 2063 is not filed by the taxpayer; an IRS agent issues it during your departure interview.

You will likely be required to file Form 1040-C and possibly pay any estimated taxes owed before departure.

Yes. Even if you are issued Form 2063, you may still be required to file Form 1040-NR or Form 1040 for the tax year.

Failing to comply with IRS departure procedures may result in penalties or issues reentering the U.S. in the future.

When conducting business across borders or managing foreign investments in the United States, it’s crucial to understand the tax implications of...

For entrepreneurs, grasping and adeptly handling business taxes is vital. This detailed guide delves into the complexities of tax preparation,...

In the field of international operations, international tax compliance demands precision and up-to-date knowledge. This article provides a clear...