Transfer Pricing Benchmark Study Analysis - Multinational Companies

Effective transfer pricing practices, including transfer pricing benchmarking analysis, are essential for multinational companies to navigate the...

With the continued shift to digital banking and the rise of fintech are we seeing the inevitable demise of traditional brick and mortar FIs? Not anytime soon. This is and can continue to be, the age of collaboration where fintech and FIs develop mutually beneficial relationships focused on reducing costs, minimizing risks, and maximizing the unique benefits both platforms have to offer. For those FIs seeking to stay competitive in an ever-evolving landscape, collaboration with fintech allows them to stay afloat in a sink-or-swim environment. For fintech seeking to secure a foothold in the crowded financial services market, collaboration with established FIs can give them the operational support needed to cement themselves as a viable financial platform.

A common type of FI/fintech relationship exists in the form of a sponsorship wherein the FI acts as a backer to a fintech company by providing operational support services, as well as providing access to the FI’s financial products and services. In most instances, the fintech’s customers are limited to non-physical banking activities, including digital checking/savings, debit cards, remote deposit capture, and peer-to-peer payments. This allows brick-and-mortar FIs access to a segment of the population (the historically unbanked) that would normally have no relationship with these institutions absent the FI/ fintech partnership. Simultaneously, FinTech benefits from access to the sponsoring institution’s operational framework and products and services, which have been tailored to meet stringent federal and state banking regulations. In these relationships, the fintech relies on the FI’s federal and state money transmitter licenses needed to move money in a given jurisdiction, and the accompanying banking charter (which can be tremendously difficult for fintech to obtain) needed to gain access to the Automated Clearing House (ACH) payment system and accept Federal Deposit Insurance Corporation (FDIC) deposits.

You may be interested in reading why do companies need to invest in technology?

Another partnership framework between fintech and traditional FIs focuses on the utilization of a custodial account that is for-benefit-of (FBO) of the fintech’s customers. The use of an FBO account is unique, as the owner of the account is not the fintech or its customers, but the bank that is partnering with the fintech. The fintech’s client funds are housed in the bank’s custodial accounts, which limits the fintech’s ability to access or independently manage the funds. The fintech customer (and other defined and authorized parties on the account) directs the activity in the account as it is the fintech customer who is treated as the account holder, not the fintech. When a fintech customer utilizes the fintech platform to request a movement of funds, the fintech forwards the customer’s orders to the bank of record who owns the custodial account where said funds are stored. Based on the instructions received from the fintech’s customer, the bank will move funds to/from the FBO account accordingly. These types of relationships are particularly beneficial to fintech, as it allow them to rely on the FI’s federal and state licenses that allow them to move money and accept deposits. Similar to a sponsoring agreement, the FBO account framework grants FIs indirect access to a previously unattainable segment of the population.

A vital component of any FI/fintech relationship is the clear delineation of compliance responsibilities between the partnering entities. Amidst ever-increasing consumer data protection regulations, anti-money laundering (AML) laws, sanctions restrictions, fair lending standards, cybersecurity risks, and more, a financial entity’s compliance framework is a web of laws, regulations, and federal/state regulators that can be tremendously difficult to navigate. This is predominantly true for fintech firms, which often experience rapid expansion but see their internal compliance departments struggling to keep pace with the firm’s overall growth. Regulators have shown no hesitancy when it comes to penalizing those fintechs who are unable to keep up with their compliance responsibilities, as evidenced by the Financial Crimes Enforcement Network’s (FinCEN) $60 million civil money penalty against a bitcoin “mixer” in 2019. The same holds true for those sponsoring FIs, demonstrated by the Officer of the Comptroller’s (OCC) consent order in January 2020 against M.Y. Safra Bank for its failure to consider AML risks and implement commensurate controls relating to its sponsorship of a cryptocurrency-related fintech. To best ensure a FI/fintech relationship successfully navigates these compliance considerations, the partnering companies must develop and thoroughly document each entity’s compliance obligations and risk ownership.

Also, read Migrate to the Cloud – high-performance databases

Any memorialized agreement between the FI and fintech must identify the particular nuances of the relationship, specifically relating to the compliance requirements that the FI will stipulate from the fintech in return for providing its financial operation support and transactional services. The contract should also include the compliance responsibilities to be undertaken by the FI, as well as the level of oversight the FI will have over the partnering fintech's operating model. It is vital that the partnership’s compliance framework is based on the outcome of a risk assessment tailored to each contracting party’s particular risk profile. The FI/fintech’s compliance framework must be ongoing and evolving, particularly considering the recent developments and changes in the United States regulatory landscape pertaining to AML compliance and cryptocurrency regulation. Ongoing compliance program testing, management oversight, staff training, and independent program reviews should all be utilized to keep the compliance framework current.

While the number and prominence of fintech were already growing at a historic rate prior to 2020, the global COVID-19 pandemic has even further accelerated the rise and importance of fintech. The use of fintech as an alternative to in-person banking has become vital in a world focused on social distancing and the limitation of face-to-face human interactions. As a result of this mass migration to digital banking, particularly in the retail space, the world has seen a dramatic decrease in reliance on cash transactions. In the U.S. alone, the percentage of cash used by total transactions has decreased from 51% in 2010 down to 28% in 2020. This shift away from cash is not limited to the banking and retail sector—as the gaming industry has also seen a dramatic migration to cashless wagering/payouts and online gaming. The shift from cash in these sectors has been a great opportunity for fintech offering digital wallets and cashless/contactless payments to establish themselves in the market. Overall, the pandemic has proven to be another major catalyst in the inevitable migration to digital banking. In the long term, the financial industry should see that migration continues as new technology emerges, the regulatory landscape changes and the end-users evolve.

Effective transfer pricing practices, including transfer pricing benchmarking analysis, are essential for multinational companies to navigate the...

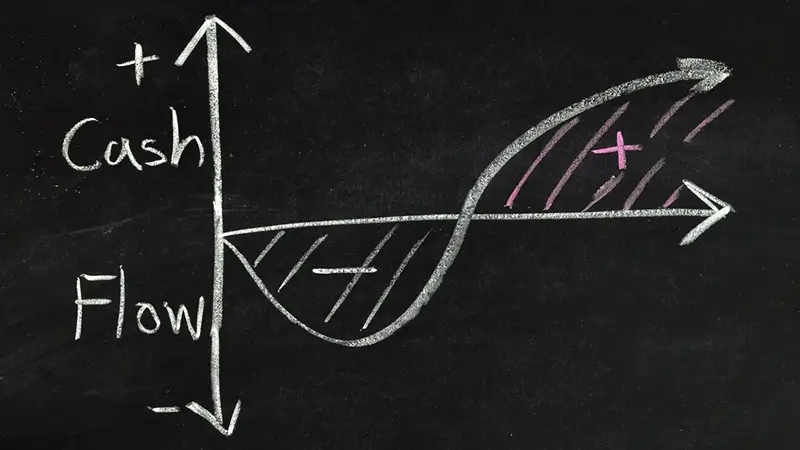

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

For entrepreneurs, grasping and adeptly handling business taxes is vital. This detailed guide delves into the complexities of tax preparation,...