Treasury Issues Final Foreign Tax Credit Regulations

The Department of the Treasury and the Internal Revenue Service on December 28, 2021 released final regulations on the foreign tax credit (FTC) for...

The U.S. Department of the Treasury and the Internal Revenue Service released final regulations on the foreign tax credit (FTC) on December 28, 2021. While the 2021 final FTC regulations generally follow the proposed regulations released on September 29, 2020, the final regulations include several important changes. Of particular significance to U.S. multinationals, the final regulations add a new “attribution requirement” to the determination of whether a foreign levy constitutes a creditable foreign income tax. In addition, taxpayers should be mindful that some of the rules in the final regulations have retroactive effects.

Section 901 allows a credit for, among other items, foreign levies that are considered income taxes paid to a foreign country. A foreign levy is a foreign income tax only if it meets the following criteria:

Prior to the 2021 final regulations, as part of determining whether a foreign tax was a net income tax, the foreign tax was required to meet a “net gain requirement,” which under the previous regulations consisted of three tests: (1) a realization test; (2) a gross receipts test; and (3) a net income test. The 2021 final regulations largely retain the net gain requirement, with some modifications. The most significant modification is the addition of a fourth test to the net gain requirement – referred to as the “attribution requirement.”

The 2021 final regulations introduce and incorporate the attribution requirement into the net gain test.[i] Under the attribution requirement, a foreign tax generally will not be creditable unless the foreign tax law requires sufficient nexus between the country and the taxpayer’s activities. The standard for whether sufficient nexus exists depends on the type of income the tax is being imposed on and

whether the tax is being imposed by the local country on a resident or a non-resident, as summarized below.

|

Residents |

Non-Residents |

||

|

Arm's Length ►Profit allocation rules in the foreign jurisdiction must be consistent with arm's length transfer pricing principles

► Foreign taxes generated in jurisdictions that don't follow arm's length transfer pricing principles may not be creditable in the U.S., such as tax generated in Brazil

|

Activities ► Applies to income generated, under reasonable principles, as a result of a nonresident's activities in the foreign jurisdiction

► The foreign jurisdiction's rules must be similar to the U.S. rules for effectively connected income (ECI) under Section 864(c) |

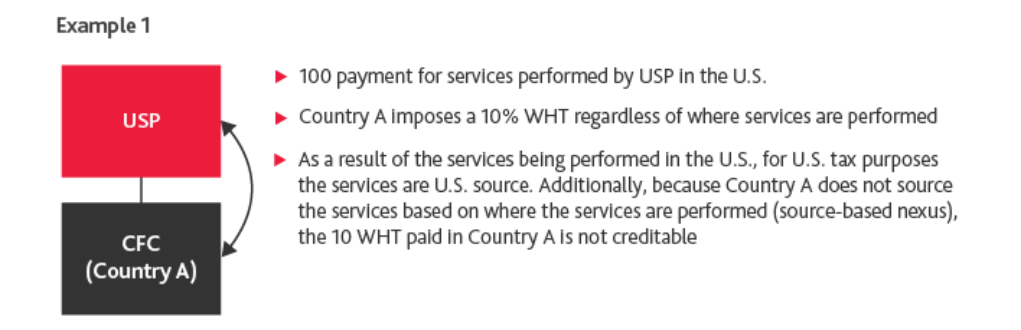

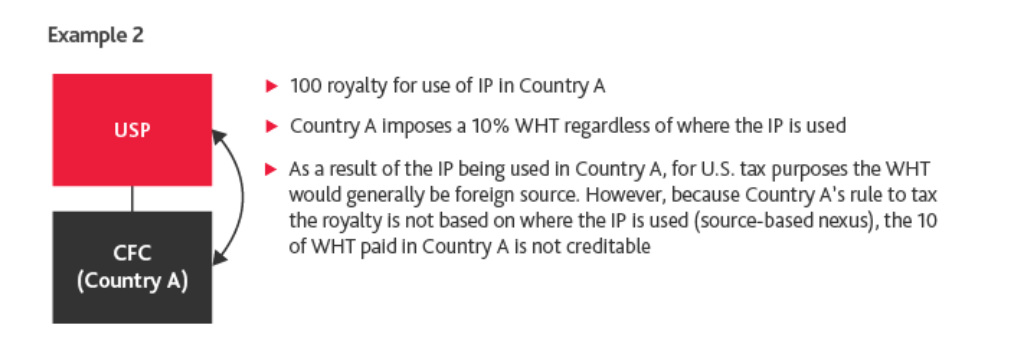

Sourcing ► Applies to income where source-based rules apply, such as services or royalties

► Sourcing rules in the foreign jurisdiction must be reasonably similar to those of the U.S. (e.g., service income sourced based on where the services are performed, royalty income sourced based on where the IP is used, etc.)

► When foreign law and U.S. law characterize gross income or gross receipts differently, foreign law characterization |

Property ► Applies to gains generated from sales or dispositions of real property located in the jurisdiction under rules similar to the U.S. Foreign Real Property Tax Act (FIRPTA)

► Also applies to business property that creates a taxable presence in the jurisdiction under rules similar to the U.S. rules for ECI under section 864(c)

|

The final regulations’ attribution requirement will likely result in additional U.S. tax for U.S. multinationals that operate in countries whose tax systems do not have nexus requirements that are sufficiently similar to the requirements imposed under U.S. tax laws. U.S. taxpayers that claim FTCs should reassess the creditability of their foreign taxes on a jurisdiction-by-jurisdiction basis. Some foreign taxes potentially impacted by the attribution requirement include:

Treaty benefits between the U.S. and the foreign jurisdiction may potentially mitigate the result of a foreign tax not being creditable under the final regulations in certain circumstances.

Examples

The following are two basic examples illustrating the potential effects of the sourcing-based rule for nonresidents as a result of the 2021 final regulations:

The rules and regulations under Section 861 govern the allocation and apportionment of expenses (including foreign income taxes) among income groupings for purposes of determining a taxpayer’s foreign tax credit limitation. The 2021 final regulations generally follow the 2020 proposed regulations for allocating and apportioning foreign income taxes on the following:

Additionally, the 2021 final regulations introduce a new rule for foreign gross income pertaining to U.S. equity hybrid instruments. Specifically, foreign income tax on foreign gross interest income generated by a U.S. equity hybrid instrument is allocated to the income grouping to which distributions pertaining to the instrument are assigned. Under the 2021 final regulations, a U.S. equity hybrid instrument is an instrument that is stock or a partnership interest under federal tax law but is debt or otherwise gives rise to the accrual of income that is not treated as a dividend or a distributive share of partnership income under foreign law.

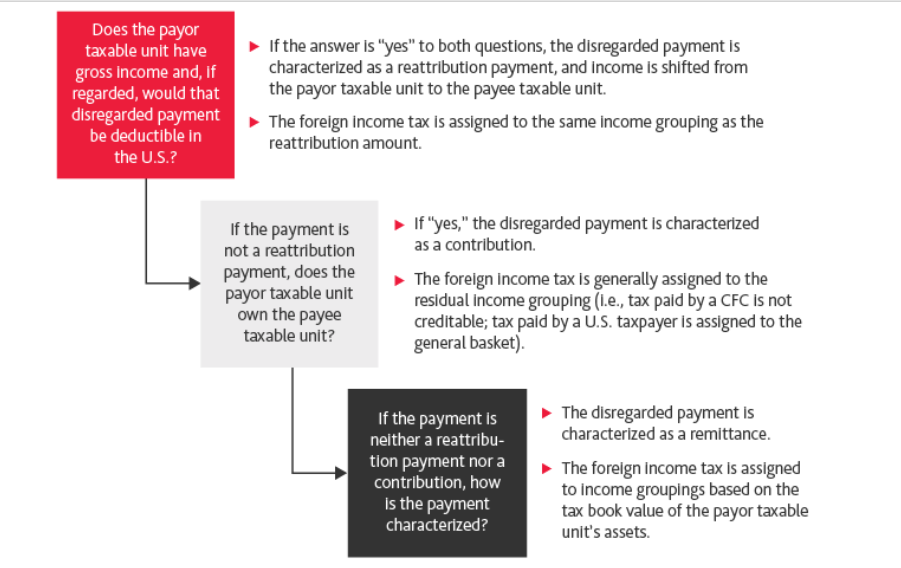

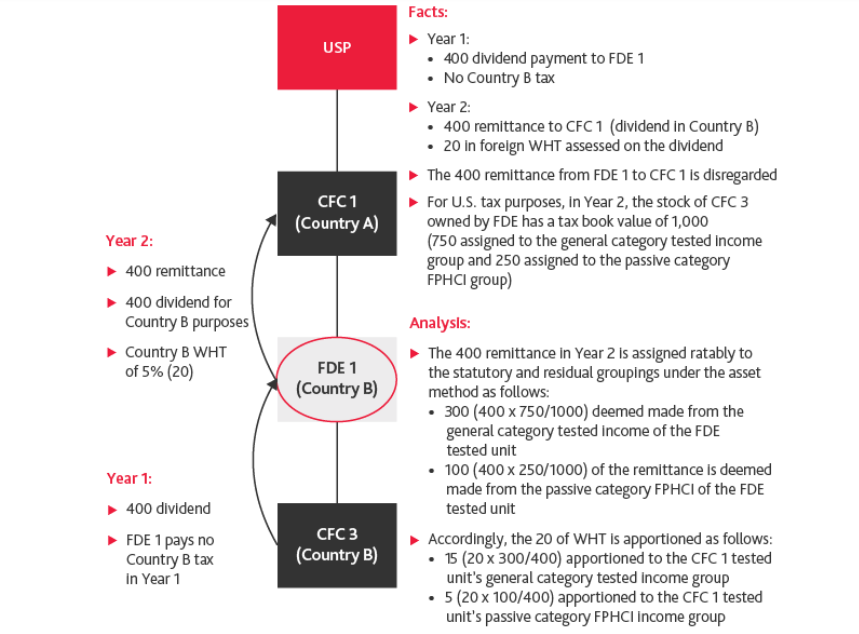

The 2021 final regulations provide guidance regarding the allocation and apportionment of foreign income taxes with respect to disregarded payments between taxable units of the same taxpayer. Taxable units, as defined, include foreign branches, foreign branch owners, and non-branch taxable units (such as foreign disregarded entities that do not give rise to branches from a U.S. tax perspective).

As set out in the following diagram, when determining the allocation and apportionment of foreign income taxes with respect to disregarded payments, the final regulations categorize a disregarded payment as one of the following types:

Examples

The following examples illustrate the mechanics of the 2021 final regulations regarding reattribution payments and remittances.

The 2021 final regulations pertaining to the allocation and apportionment of foreign income taxes apply retroactively to tax years that begin after December 31, 2019, and that end on or after November 2, 2020.

Taxpayers should take steps to identify their disregarded payments to determine the proper method of allocating and apportioning foreign income taxes for FTC limitation purposes. As these provisions of the final regulations are retroactively effective for tax years that begin after December 31, 2019, taxpayers should identify positions taken on previous tax returns to determine if they are consistent with the 2021 final regulations, or whether an amended return or potential controversy procedures should be considered.

The Department of the Treasury and the Internal Revenue Service on December 28, 2021 released final regulations on the foreign tax credit (FTC) for...

The United States-France Tax Treaty plays a pivotal role in fostering cross-border trade and investment between the two nations. The impact of the...

Navigating the world of taxes can be a daunting task, with its ever-evolving laws, complex calculations, and seemingly endless list of deductions and...