U.S. Income Tax Return of a Foreign Corporation -Form 1120-F

As the owner of a foreign corporation with U.S. business activities, you have specific tax filing obligations in the United States. One of these...

Foreign individuals with income in the US need to be acquainted with IRS Form 1040-NR. It is the designated form for nonresident aliens to report income earned in the United States. All nonresident aliens with US-sourced income must file this form, such as wages, salaries, tips, dividends, interest, rents, royalties, pensions, and annuities. Should you be unable to file by the deadline, it is advisable to request a filing extension to avoid penalties.

Form 1040-NR is the tax return form used by nonresident aliens who earn income in the United States or conduct business there but do not qualify as resident aliens for tax purposes. It must be filed with the Internal Revenue Service.

The IRS estimates that it takes taxpayers an average of eight hours to complete this form. Although the instructions are relatively straightforward, they span over 30 pages and are specific to foreign individuals, with various international tax laws also applying. Consequently, many foreign individuals opt for professional assistance to minimize their income tax liability.

A resident alien for tax purposes is an individual who is a citizen of the United States or who is a legal permanent resident of the United States. A nonresident alien for tax purposes is an individual who is not a legal permanent resident of the United States and who meets neither the green card test nor the substance present test, see below.

Resident individuals are taxed on their worldwide income while nonresident aliens are only taxed on their income from sources within the United States. Resident individuals file Form 1040 US income tax return while nonresident individuals file Form 1040-NR.

If you are not a U.S. citizen, you are considered a nonresident alien for tax purposes. However, if you meet either the green card test or the substantial presence test, you are classified as a resident alien for tax purposes.

Green card test: You are a lawful permanent resident of the United States, at any time, if you have been given the privilege, according to the immigration laws, of residing permanently in the United States as an immigrant. You generally have this status if the U.S. Citizenship and Immigration Services (USCIS) issues you a Permanent Resident Card, Form I-551, also known as a "green card test." If you meet the green card test at any time during the calendar year but do not meet the substantial presence test for that year, your residency starting date is the first day on which you are present in the United States as a lawful permanent resident.

The substantial presence test: You will be considered a United States resident for tax purposes if you meet the substantial presence test for the calendar year. To meet this test, you must be physically present in the United States (U.S.) on at least:

31 days during the current year, and

183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

All the days you were present in the current year, and

1/3 (one-third) of the days you were present in the first year before the current year, and

1/6 (one-sixth) of the days you were present in the second year before the current year.

Tax Tips: You should check to see if the IRS has a treaty with your country. Residency status for treaty purposes is determined by the applicable treaty. If you are treated as a resident of a foreign country under your country tax treaty, and not treated as a resident of the United States under that treaty, you are treated as a nonresident alien in figuring your U.S. income tax.

A foreign individual or nonresident alien involved in a U.S. trade or business is required to file an income tax return, even if the business generates no income. Additionally, foreigners receiving passive income without tax withholding are obligated to file U.S. income tax returns. Moreover, if a foreign individual is subject to specific U.S. taxes, such as those on qualified retirement plans or social security or Medicare taxes, they must file a U.S. nonresident alien income tax return. There are various other situations where foreigners are required to file a U.S. income tax return. The filing requirement for a foreign person is fulfilled by submitting Form 1040-NR.

You must file Form 1040-NR if you are a nonresident alien for taxes and you have income from U.S. sources that is subject to tax. Yes, if you are a nonresident alien, you are required to file Form 1040-NR if:

You are considered to be engaged in a trade or business in the United States during the year, like having a business in the United States or

You are not engaged in a trade or business in the United States but you have U.S. income on which the tax liability was not satisfied by the withholding of tax, (interest income received from US payor other than a bank, dividends received from US corporations, rent and royalties from US properties) or

You owe any special taxes

You should consult with your tax advisor regarding your filing requirements because there are many other instances when you may have to file even if you are a nonresident alien.

Tax Tips: If you are not sure whether you have to file a US tax form 1040-NR nonresident alien income tax return or not, it is better to file the form as a protective measurement because the statute of limitation starts running from the day that you file the return, usually three years. If you don't file the return at all, the IRS has unlimited time to examine your return.

If a foreign person engages in a trade or business in the United States, all income from sources within the United States connected with the conduct of that trade or business is considered to be Effectively Connected Income (ECI). Effectively connected to US trade or business income includes personal services performed in the US, sales of personal properties, sale of real estate located in the US, scholarships, grants, prizes paid in the US for activities in the US, and pension income related to U.S. services.

Even though you would otherwise meet the substantial presence test, you can be treated as a nonresident alien if you are considered to have a closer connection to your country. To prove the closer connection, you have to:

Prove that you were present in the United States for fewer than 183 days during the tax year,

Establish that during the tax year, you had a tax home in a foreign country, and

Establish that during the tax year, you had a closer connection to your home country than to the United States

Usually, you are not eligible for the closer connection exception if you have an application pending for adjustment of status to that of a lawful permanent resident or if you have applied, or have taken steps to apply, for lawful permanent residence. You must file a fully completed Form 8840 with the IRS to claim the closer connection exception. IRC 7701(b)(3)(B)

You are not required to file Form 1040-NR if you meet any of the following criteria:

Your only income from U.S. sources is wages, salaries, tips, refunds of state and local income taxes, interest, dividends, business or farm profits, pensions, annuities, IRA distributions, unemployment compensation, or social security benefits; and

You elect to have tax withheld on this income by completing a W-4 form (or similar form) for your employer; and

Your employer withholds the proper amount of tax from your paychecks. Your withholding tax is the amount deducted from your earnings and sent to the Internal Revenue Service on your behalf. There are some circumstances where your income tax withholding satisfies your tax return obligations.

Compensation of employees of foreign government are exempted from US income tax. Section 893 provides special rules for employees of international governments and international organizations. Under this section of the International Revenue Code, compensation income is exempt from US income tax and the residency of the employee is irrelevant. It is important to notice that this exception does not apply to the employee's other sources of US income.

The main difference between Form 1040 and Form 1040-NR is that nonresident aliens cannot claim certain deductions and credits that are available to resident aliens. In addition, Form 1040-NR is used to report income from U.S. sources only, while Form 1040 is used to report income from both U.S. and foreign sources. Form 1040 can be considered more complicated than Form 1040-NR. Depending on your resident status for income taxes, you will use one of these forms.

Tax Tips: Dual status at the end of the tax year determines whether you file Form 104o or Form 1040-NR. You should write "Dual status return" on top of the return.

Form 1040-NR is generally due on the 15th day of the 4th month following the end of your tax year (April 15 for calendar year taxpayers).

You can electronically file (e-file) Form 1040-NR and if you e-file your return, there is no need to mail the form. However, if you have to mail the form to the government, see the current address provided by the IRS on their website. Usually, the 1040-NR forms and payments are mailed to: the Internal Revenue Service, P.O. Box 1303, Charlotte, NC 28201-1303, U.S.A.

To complete Form 1040-NR, you will need information about your income and expenses. You will also need your Social Security number or Individual Taxpayer Identification Number (ITIN). If you don't have an ITIN, you can apply for one with the Internal Revenue Service.

Income. You will need to report all income you received from U.S. sources, including wages, salaries, tips, refunds of state and local income taxes, interest, dividends, business or farm profits, pensions, annuities, IRA distributions, unemployment compensation, and social security benefits.

Expenses. You will need to report any expenses you incurred in connection with your U.S. trade or business, such as the cost of goods sold, employee salaries and wages, rent, utilities, and supplies.

Tax Tips: a foreign person or nonresident alien filing Form 1040-NR cannot use the standard deduction nor claim itemized deductions. If it is beneficial to the foreign individual, he or she may want to make an election to be treated as a resident alien for tax purposes.

If you did not file form 1040-NR for one or more previous years, you should file those returns as soon as possible. You may be subject to penalties and interest if you owe taxes and do not file a return. If you need help preparing your return, there are many resources available, including IRS Publication 519, U.S. Tax Guide for Aliens, and IRS Publication 901, U.S. Tax Treaties. You can also work with an international tax professional to help you minimize your income tax.

If you do not file Form 1040-NR, you may be subject to penalties and interest. In addition, if you owe taxes and do not pay them, the IRS may take enforcement action against you, such as seizing assets or levying against your bank account. The penalty for not filing Form 1040-NR or filing it late is 5% of the unpaid tax for each month (or partial month) that the return is late, up to a maximum of 25%. In addition, you may have to pay interest on the unpaid tax. The interest rate is currently about 5% per year, compounded daily. If you do not pay your tax when it is due, you may also be liable for a late payment penalty of 0.5% of the unpaid tax for each month (or partial month) that the payment is late, up to a maximum of 25%.

By not filing your nonresident alien income tax, your visa can be revoked. Immigration visa terms require that visa holders fully comply with US tax laws by filing their taxes. To apply or make changes to your visa, you will have to show proof that you are current with your U.S. taxes. The terrible consequence of not filing your taxes is the fact that you are putting your U.S. residency status at risk. Make sure to be fully aware of all visa terms.

Yes, a nonresident alien can file Form 1040 by making an election to be treated as a resident alien even if he or she did not need a green card test, and was not in the U.S. enough days to meet the substantial presence test. A nonresident alien can elect under Section 7701(b)(4) of the Internal Revenue Code to be a U.S. resident for income tax purposes. A nonresident alien will make this election to be able to claim the standard deductions or itemize deductions such as real estate taxes, mortgage deductions or charitable deductions which otherwise he or she would not be able as to a nonresident alien. In addition, the election can be beneficial if the foreign individual has foreign losses in the current year and he or she wants to take those losses in the current year's income tax return.

Tax Tips: If a nonresident is married to a U.S. resident, an election can be made under Section 6013(g) to be treated as a full-year U.S. resident by attaching the election to the U.S. joint income tax return. The election is effective until rescinded/revoked, death, legal separation, or revoked by the Internal Revenue Service for inadequate records.

Nonresident aliens have to file state taxes if they received U.S. and State source income during the tax year. Many states use the domicile test or facts and circumstances test combined with the 183 general test to determine the residency of the foreign individual. The determination of residence is made state by state, not at the federal level.

A nonresident alien, in general, is liable for Social Security/Medicare Taxes on wages paid to him or her for services performed in the United States, with certain exceptions. The exemptions are based on their nonimmigrant status. Nonresident aliens with visas F, J or Q are exempt from social security taxes. All other nonresident aliens present in the U.S. with any other work visa are subject to social security taxes.

Yes, a nonresident alien qualifies for the Section 121 exclusion ($250,000) if he or she meets both the ownership test and the use test. The nonresident alien must have owned and used the house as his primary home for a least two out of the last five years. The exclusion is available for a spouse and it must be claimed separately on each Form 1040-NR.

If you have any questions about your filing requirements, you should contact the IRS at 1-800-829-1040. Additional Resources: IRS Publication 519, U.S. Tax Guide for Aliens, IRS Publication 901, U.S. Tax Treaties, IRS Website: www.irs.gov, and Phone Number: 1-800-829-1040.

Tax Tips: There are special rules for former U.S. Citizens former U.S. long-term residents who have lost their citizenship and long-term residents who have ended their residency. You are a former U.S. long-term resident if you were a lawful permanent resident of the United States (green card holder) in at least 8 of the last 15 tax years ending with the year your residency ends. If this is your case, you should consult with an international tax professional to help file your income tax return.

At H&CO, we specialize in international tax services for foreign corporations and investors, ensuring compliance with U.S. regulations and effective tax risk management.

Our seasoned professionals are equipped to clarify the tax implications and penalties tied to your U.S. business activities and investments. We offer expert advice on accurately preparing your Form 1040-NR. With our assistance, you can be confident that your U.S. ventures are in line with both U.S. and international tax statutes. For more information, please refer to our international tax services section.

As the owner of a foreign corporation with U.S. business activities, you have specific tax filing obligations in the United States. One of these...

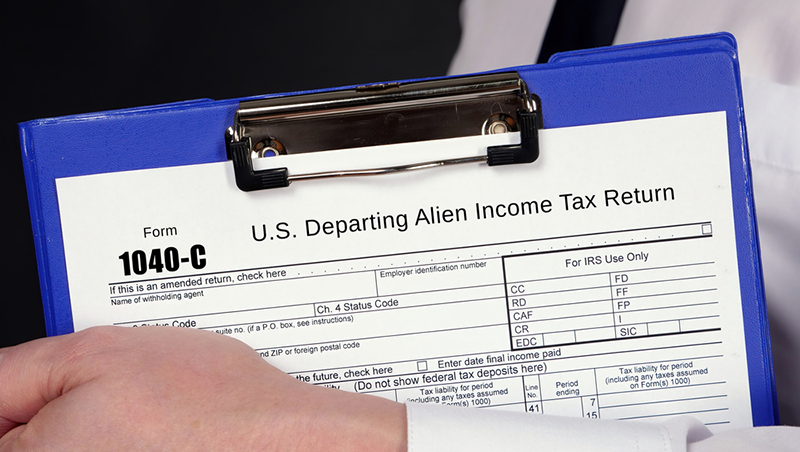

When foreign nationals (non-U.S. citizens) prepare to leave the United States, they must typically fulfill specific tax obligations prior to their...

Last updated May 5, 2025.

.webp)