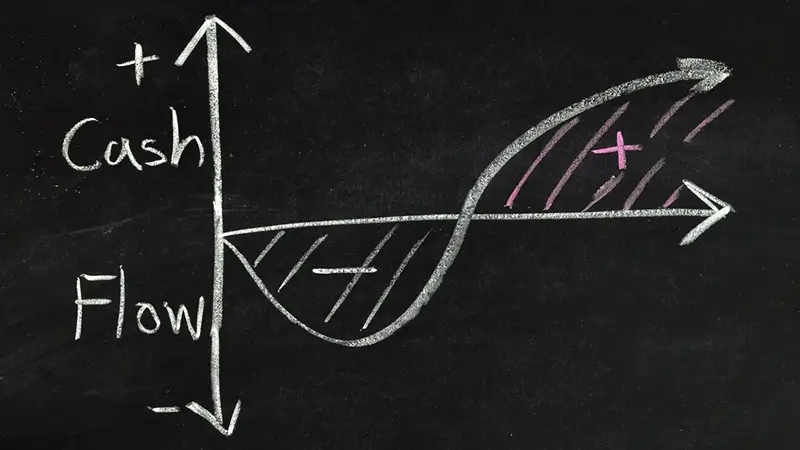

Cash Flow Management Explained: The Lifeblood of Your Business

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

When hiring an individual or CPA firm to prepare a tax return, filers need to understand who they're choosing and what important questions to ask.

A taxpayer's needs will determine which kind of preparer is best for them. Whether taxpayers regularly use a tax professional to help them file a tax return, or have decided to work with one for the first time, choosing a tax professional is important. Taxpayers are ultimately responsible for all the information on their income tax return, regardless of who prepares the return.

By law, anyone who is paid to prepare or assists in preparing federal tax returns must have a valid Preparer Tax Identification Number. Paid preparers must sign and include their PTIN on any tax return they prepare.

Not signing a return is a red flag that the paid preparer may be looking to make a quick profit by promising a big refund or charging fees based on the size of the refund. Taxpayers should avoid these unethical "ghost" tax return preparers.

A ghost preparer is someone who doesn't sign the tax returns they prepare. Unscrupulous ghost preparers often print the return and have the taxpayer sign and mail it to the IRS. For electronically filed returns, a ghost preparer will prepare the tax return but refuse to digitally sign it as the paid preparer.

Here are some tips to keep in mind when choosing a Certified Public Accountant (CPA) for your tax returns:

Our CPA firm has over 30 years of experience preparing tax returns for global families and multinational organizations. Do not hesitate to request a consultation with our certified experts!

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

To help you choose between these concepts for your business, first understand their definitions and then consult your trusted CPA.

A strong understanding of Generally Accepted Accounting Principles (GAAP) is essential for businesses operating in the United States. GAAP provides...