What is a Partnership in the US

Partnerships, including partnerships with foreign partners, have many filing and reporting requirements. In addition to filing annual partnership tax...

Imagine a business structure that combines the versatility and control of a partnership with the protection against the liability of a corporation. That's the remarkable benefit of an LLP. Partners in an LLP have the freedom to organize their internal operations as they see fit, without being personally responsible for the business's debts or wrongdoings beyond their invested capital. This guarantees that your personal assets, such as your car or house, remain safeguarded from creditors, bringing you invaluable peace of mind.

In this article, we will navigate the key points that every entrepreneur who undertakes new businesses in the United States must be informed and advised by a lawyer or a CPA on the tax aspects of each of the existing structures.

| Table of Contents |

You might read about Types of Partnerships in the United States

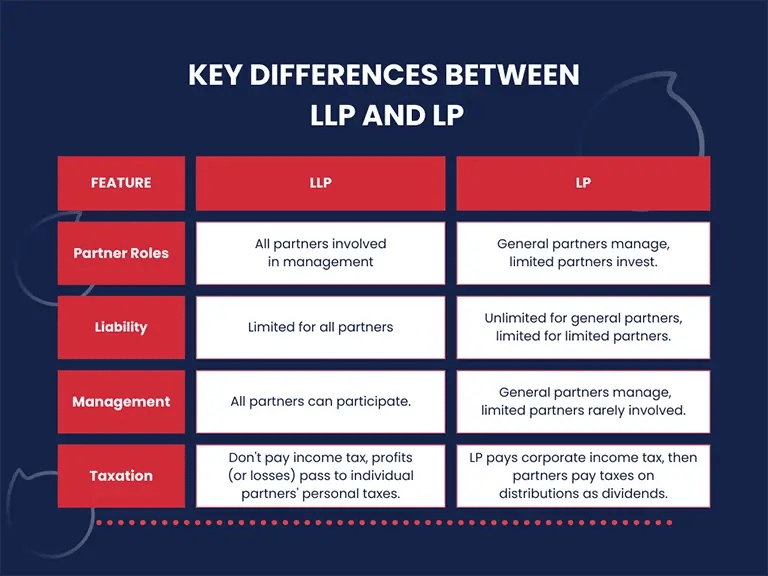

In an LLP, all partners benefit from limited liability for the partnership's debts and obligations, which means their personal assets (such as houses and cars) are generally safeguarded from claims against the business. However, it is important to note that there may be exceptions if a partner engages in fraudulent or negligent behavior.

On the other hand, in an LP, only limited partners enjoy limited liability. General partners, similar to those in a general partnership, bear unlimited personal liability.

Professionals who opt for LLPs heavily rely on their established reputation. LLPs are typically formed and managed by a group of experienced professionals who have a strong client base. By pooling their resources, these partners can reduce business costs while simultaneously expanding the growth potential of the LLP. They can share office space, employees, and other resources, which ultimately leads to increased profitability.

Additionally, an LLP may have several junior partners who work for the firm with the aspiration of becoming full partners in the future. These junior partners receive a salary and typically do not have any financial stake or liability in the partnership. However, it is important to note that they are designated professionals who possess the necessary qualifications to contribute to the work brought in by the partners.

One of the ways that LLPs benefit partners is by allowing them to expand their operations. By having junior partners and employees handle the detailed work, the partners can focus on bringing in new business and growing the LLP. Additionally, LLPs have the advantage of being able to add or retire partners as outlined in the partnership agreement. This flexibility is useful because it allows the LLP to bring in partners who already have an existing business, and the decision to add partners usually requires approval from all existing partners.

You might also read LLC vs. Corp: Choosing the Right Business Structure

LLPs and LLCs both provide limited liability, but they serve different purposes and have unique features. To help you determine the best fit for your needs, let's explore some key distinctions between these two business structures:

It is highly advisable to seek guidance from a business advisor or attorney when determining the most appropriate legal structure for your venture. Remember, the optimal choice for your business depends on your specific needs and goals.

These are some related questions that individuals usually have about LLPs.

LLPs are commonly established by professional firms, including medical practices, accounting firms, and law offices.

LLPs are considered “pass-through” entities in the eyes of the IRS, meaning the LLPs’ profits and losses are reflected on the partners’ personal income tax returns while the company itself pays no taxes.

The process of establishing an LLP can differ from state to state. It is advisable to visit the Small Business Administration's website to learn about the specific filing requirements in your state.

The disadvantages of an LLP can vary depending on the state's regulations. However, in general, it's important to note that LLPs are not available nationwide and are limited to certain professions. Additionally, LLPs are unable to file taxes as an S corporation and must have a minimum of two partners, including a managing partner.

At H&CO, our experienced team of tax professionals understands the complexities of income tax preparation and is dedicated to guiding you through the process. With offices in Miami, Coral Gables, Aventura, Tampa, and Fort Lauderdale, our CPAs are readily available to assist you with all your income tax planning and tax preparation needs. To learn more about our accounting firm services take a look at our individual tax services, business tax services, international tax services, expatriate tax services, SAP Business One, entity management, human capital, and audit and assurance services.

Partnerships, including partnerships with foreign partners, have many filing and reporting requirements. In addition to filing annual partnership tax...

Expanding into international markets is a significant strategic move, not just a legal formality. Foreign direct investment plays a crucial role in...

Having a strong understanding of GAAP accounting is essential. GAAP encompasses a set of standards that govern the intricacies, complexities, and...

.webp)