Cash Flow Management Explained: The Lifeblood of Your Business

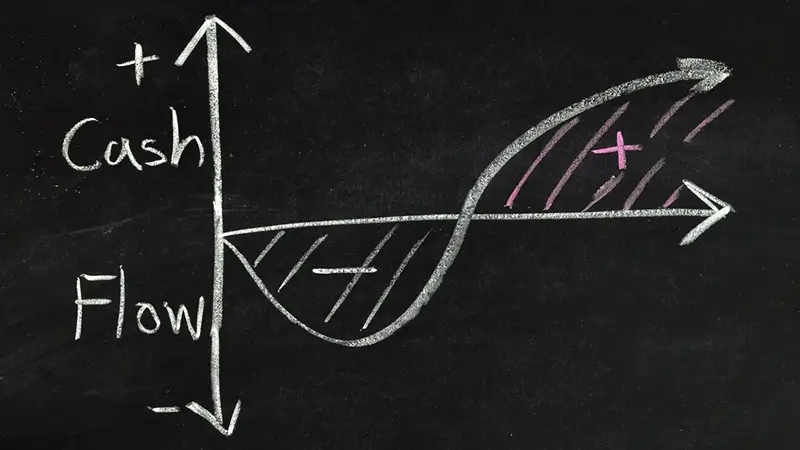

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

Contractors trying to keep their construction companies financially healthy face two intrinsic challenges: the seasonal nature of construction work and the unpredictability of an invoice-based business. Both can disrupt cash flow and make collecting and paying bills challenging. With positive cash flow, your balance sheet is better able to handle the industry's typical ups and downs plus any curveballs thrown by outside forces — such as the COVID-19 pandemic. Here's how to promote a freer flow of cash.

To maintain a healthy cash flow, consider the following best practices:

As many contractors learned during the 2020 project shutdowns, it's essential to have a financial cushion big enough to weather extended storms — either literal or figurative. Estimate your company's average monthly expenses and set a goal to save enough cash to cover them without the benefit of revenue during whatever timeline you deem necessary. Most construction businesses probably should aim for three to six months. Budget contributions to your cash reserve as a fixed expense — and pay back the reserve if you have to dip into it.

Financing is a good way to free up working capital. Instead of buying construction equipment and vehicles outright, financing or leasing at a low rate helps you keep cash on hand for business operations. You might also want to avoid prepaying for insurance or other expenses that allow installment payments, unless, of course, you receive a big discount for paying in full immediately.

Business lines of credit and revolving credit provide immediate access to a fixed amount of money. In general, you can use credit for general expenses such as payroll, materials, and monthly bills. Much like using a credit card, your request only what you need at the time and pay interest on what you use.

Talk to suppliers to get the best offer on materials, letting them know you're "shopping around" for a good deal. Unless you receive a discount to pay upfront, use financing or ask about flexible payment options. Remember, in most cases, if you pay suppliers and other vendors before you get paid, you run the risk of running out of cash.

The sooner you bill, the sooner you get paid. Prompt invoicing is critical in an industry that's notorious for long lead times between billing and payment. Follow the invoice schedule outlined in your contracts and regularly call and follow up on those that aren't paid promptly. And if you haven't already, set up your business to accept electronic payments.

When drafting subcontracts, include a provision that ties subcontractor payment to when you receive payment from the project owner. This protects against spending money you don't have.

This means preparing a cash flow projection and making any necessary adjustments over the course of the job. Monitor work-in-progress and cash flow reports helping identify potential financial issues while you still have time to address them. Also, track the status of overbilling and underbilling to ensure you're billing as close to your costs as possible.

Rather than waiting for project completion, process change orders immediately. That way, you can get approved quickly and bill for those additional costs as they come in. Additionally, turn in project closeout documents promptly so you can receive final payments sooner.

You can't control what doesn't get measured. So study job-costing reports to ensure you're pricing services correctly and bidding profitable jobs. Perform cash flow analysis to know where money is going, where it's coming from, and how much you have on hand. Key metrics and ratios to track include:

© Copyright 2021 Thomson Reuters

All rights reserved

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

To help you choose between these concepts for your business, first understand their definitions and then consult your trusted CPA.

Your investment losses can help reduce taxes by offsetting gains or income. Even if you no longer have any gains, harvesting losses can be beneficial...