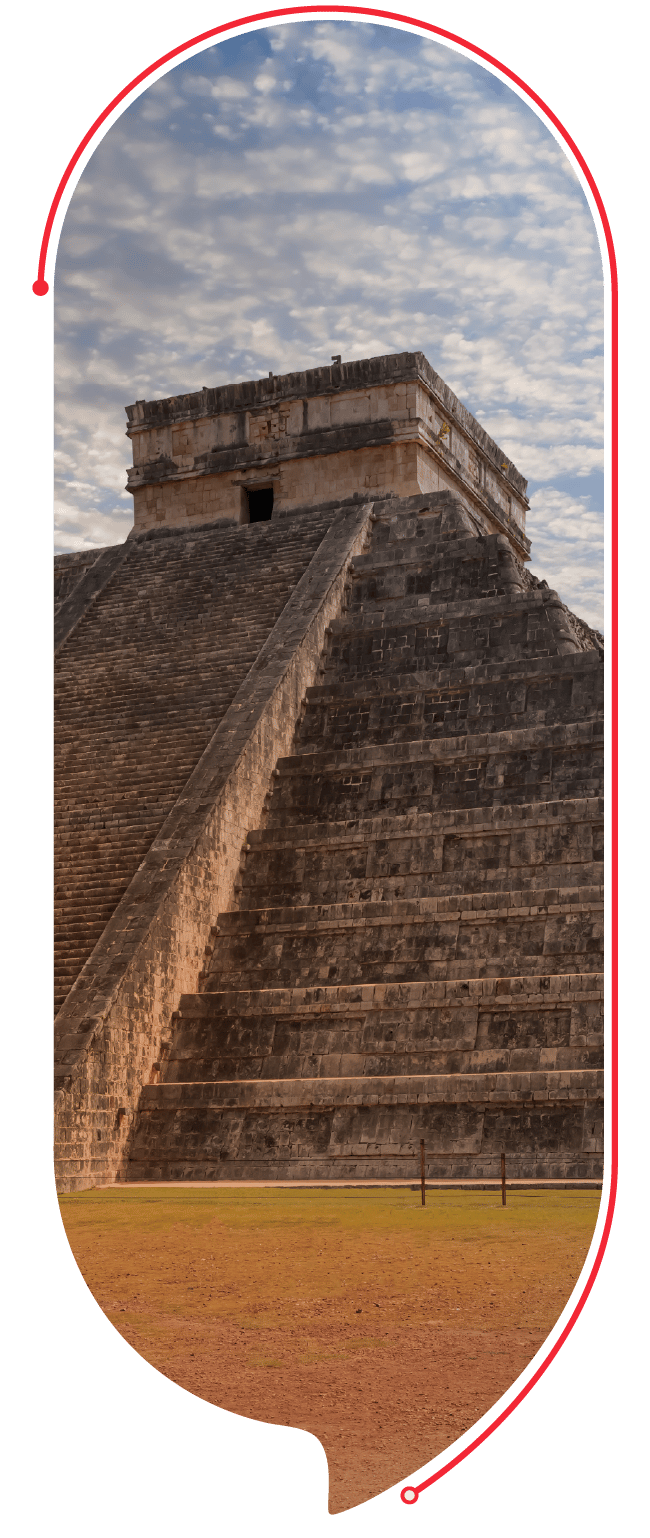

Doing business in Mexico

Mexico is one of the most attractive destinations for businesses looking to expand into Latin America, thanks to its strategic location, competitive labor costs, and strong trade agreements like The United States-Mexico-Canada Agreement (USMCA) and numerous free trade agreements. However, navigating Mexico’s regulatory environment, tax system, labor laws, and financial operations can be complex without the right expertise.

At H&CO, we provide end-to-end solutions to help businesses successfully establish a business in Mexico—whether you need entity formation, human capital, global technology support, accounting, payroll management, tax compliance and international trade guidance.

Challenges of Expanding into Mexico

While Mexico offers significant business opportunities, expansion comes with challenges. Navigating bureaucratic regulations, security risks, strict labor laws, and infrastructure limitations can complicate operations. Businesses must plan strategically to manage compliance, logistics, and workforce regulations effectively.

Bureaucracy & Regulatory Complexity

Expanding into Mexico requires navigating complex legal requirements, including business registration, tax compliance, and permit acquisition, with multiple government agencies involved. Bureaucratic inefficiencies create concerns for businesses operating in Mexico.

Security & Safety Concerns

Crime rates vary across different regions, with some areas experiencing higher risks. These security challenges can affect supply chains, logistics, and employee safety, requiring businesses to implement risk management strategies.

Strict Labor Laws & High Employee Costs

Mexico's labor laws are designed to protect employees, making layoffs complex and expensive. Employers must comply with mandatory benefits, including profit-sharing (PTU), social security, and severance pay, all governed by the Federal Labour Law.

Infrastructure & Logistics Bottlenecks

While major cities have well-developed infrastructure, rural areas often face challenges such as unreliable roads, limited utilities, and inefficient transportation networks, which can impact distribution and operational efficiency.

Why Invest in Brazil?

Brazil is one of the largest economies in Latin America and the Caribbean, according to the gross domestic product (GDP) recorded in 2023. In that year, the value of goods and services produced in Brazil reached an estimated $2.12 trillion USD, based on current values.

The country boasts a diverse and robust economy driven by key industries such as agribusiness, where it leads global production and exports of soybeans, sugarcane, and coffee; mining, as the largest exporter of iron ore and a significant producer of gold, aluminum, and oil; and renewable energy, with hydropower as its main energy source and growing investments in wind, solar, and ethanol production.

This economic strength, combined with abundant natural resources and opportunities for growth, makes Brazil a prime destination for investment.

Opportunities of Doing Business in Mexico

Mexico’s strategic location, cost-effective operations, and growing consumer market make it a prime destination for international businesses. With strong manufacturing, USMCA trade benefits, and thriving tech sectors, it offers valuable opportunities for expansion, supply chain optimization, and investment.

Strategic Location

Mexico’s proximity to the U.S. and access to major global trade routes make it a prime location for international businesses seeking efficient market entry and global expansion.

Cost-Effective Operations

Competitive labor costs, lower operational expenses, and a well-developed supply chain infrastructure enhance profitability and efficiency for businesses in Mexico.

Growing Consumer Market

With a rapidly expanding middle class and rising purchasing power, Mexico presents strong demand across industries, making it a lucrative market for businesses.

Government Incentives

Businesses can benefit from Mexico’s special economic zones, tax incentives, and trade agreements, which reduce costs and encourage foreign investment.

Manufacturing & Nearshoring Opportunities

As a global leader in automotive, aerospace, and electronics manufacturing, Mexico attracts companies shifting production closer to the U.S. for improved supply chain efficiency.

USMCA Trade Benefits

The United States-Mexico-Canada Agreement (USMCA) provides duty-free trade, reduced tariffs, and investment advantages, making cross-border business more cost-effective.

Thriving Tech & Innovation Sector

Mexico’s booming fintech, e-commerce, and digital transformation industries create vast opportunities for businesses looking to invest in technology and innovation.

Why Invest in Brazil?

Brazil is one of the largest economies in Latin America and the Caribbean, according to the gross domestic product (GDP) recorded in 2023. In that year, the value of goods and services produced in Brazil reached an estimated $2.12 trillion USD, based on current values.

The country boasts a diverse and robust economy driven by key industries such as agribusiness, where it leads global production and exports of soybeans, sugarcane, and coffee; mining, as the largest exporter of iron ore and a significant producer of gold, aluminum, and oil; and renewable energy, with hydropower as its main energy source and growing investments in wind, solar, and ethanol production.

This economic strength, combined with abundant natural resources and opportunities for growth, makes Brazil a prime destination for investment.

Simple Solutions for Expanding into Mexico

Expanding into Mexico presents both opportunities and challenges, but H&CO offers simple solutions to help businesses mitigate risks, ensure compliance, and achieve long-term success in the region.

Market Entry & Expansion Support

We provide expert local insights, comprehensive market research, and strategic business development solutions to help you establish a strong presence and successfully expand your business operations in Mexico.

Business Registration Made Easy

Simplify your business setup with our end-to-end support for entity formation, tax registration, and regulatory approvals, ensuring a smooth and compliant process without unnecessary delays.

Staffing & Talent Solutions

Build a high-performing and fully compliant workforce with our recruitment services, workforce management solutions, and HR compliance support tailored to the unique labor laws in Mexico.

SAP Business One Implementation & Support

Optimize your business operations with SAP Business One, a powerful ERP solution designed for small and medium-sized enterprises. Our team provides seamless implementation, customization, training, and ongoing support to enhance efficiency and streamline processes.

Accounting & Financial Management

Keep your finances on track with our outsourced accounting, bookkeeping, and ERP solutions, including SAP Business One and other leading platforms, designed to enhance financial organization and operational efficiency.

Payroll & Labor Compliance

We provide full payroll management, including accurate payroll processing, social security contributions, and administration of mandatory employee benefits, ensuring compliance with Mexican labor laws while preventing costly disputes.

International Tax Compliance & Optimization

Our experienced tax specialists offer tailored tax solutions to minimize liabilities, manage VAT obligations, and ensure full compliance with Mexican transfer pricing regulations, helping you reduce tax burdens and maximize profitability.

Why Invest in Brazil?

Brazil is one of the largest economies in Latin America and the Caribbean, according to the gross domestic product (GDP) recorded in 2023. In that year, the value of goods and services produced in Brazil reached an estimated $2.12 trillion USD, based on current values.

The country boasts a diverse and robust economy driven by key industries such as agribusiness, where it leads global production and exports of soybeans, sugarcane, and coffee; mining, as the largest exporter of iron ore and a significant producer of gold, aluminum, and oil; and renewable energy, with hydropower as its main energy source and growing investments in wind, solar, and ethanol production.

This economic strength, combined with abundant natural resources and opportunities for growth, makes Brazil a prime destination for investment.

Why Doing Business in Mexico?

Why Invest in Brazil?

Brazil is one of the largest economies in Latin America and the Caribbean, according to the gross domestic product (GDP) recorded in 2023. In that year, the value of goods and services produced in Brazil reached an estimated $2.12 trillion USD, based on current values.

The country boasts a diverse and robust economy driven by key industries such as agribusiness, where it leads global production and exports of soybeans, sugarcane, and coffee; mining, as the largest exporter of iron ore and a significant producer of gold, aluminum, and oil; and renewable energy, with hydropower as its main energy source and growing investments in wind, solar, and ethanol production.

This economic strength, combined with abundant natural resources and opportunities for growth, makes Brazil a prime destination for investment.

Mexican Economy

Mexico in Figures

- Population: 129.8 million inhabitants

- Urban Population: 102.8 million inhabitants (79%)

- Currency: Mexican Peso (MXN)

- Official Language: Spanish

- GDP per Capita: US$10,045 (2023)

Political System: Mexico operates as a federal presidential representative democratic republic, where power is divided among federal, state, and local governments, with an elected president serving as both head of state and government.

International Tax Treaties: Mexico has double taxation agreements (DTAs) with 60+ countries, including: 🇺🇸 United States 🇨🇦 Canada 🇬🇧 United Kingdom 🇩🇪 Germany 🇫🇷 France 🇪🇸 Spain 🇧🇷 Brazil 🇦🇷 Argentina 🇮🇳 India 🇯🇵 Japan 🇰🇷 South Korea 🇦🇺 Australia 🇨🇳 China 🇵🇹 Portugal 🇮🇹 Italy and many others.

Interesting Facts: Mexico’s population represents 1.6% of the total world population, and its total land area is 1,964,375 km² (758,449 sq. miles), making it the 14th largest country in the world.. Mexico’s economic strength, strategic location, and trade agreements make it a top destination for international business expansion

Mexico’s Economy & Business Environment

Mexico’s Economy: A Thriving Market for Global Business

Mexico boasts one of the largest and most dynamic economies in Latin America, driven by strong industrial sectors, a growing middle class, and extensive trade agreements. As a top manufacturing powerhouse, Mexico excels in automotive, aerospace, electronics, and technology production, attracting multinational corporations seeking cost-efficient operations and skilled labor. The country’s strategic trade partnerships, including the USMCA, CPTPP, and EU-Mexico Free Trade Agreement, enhance its role as a global export leader.

Business Environment in Mexico

Mexico’s economy is diverse and highly industrialized, with major sectors including manufacturing, automotive, aerospace, real estate, technology, and financial services. The country has become a regional leader in production and exports, attracting foreign investors looking to tap into its skilled workforce and cost-effective operations. With a stable economic outlook and ongoing development, Mexico continues to be a top choice for international business expansion.

International Investment Laws

Mexico welcomes foreign investment, allowing international businesses to operate, expand, and invest across various industries. However, companies must comply with local laws, industry-specific regulations, and investment restrictions in certain sectors such as energy and telecommunications. Understanding these regulations ensures smooth market entry and sustainable operations.

Regulatory Requirements & Mexican Government

Businesses operating in Mexico must adhere to strict tax, labor, and corporate compliance regulations. Key regulatory bodies include SAT (Mexican Tax Authority) for tax compliance, IMSS (Social Security) for employee benefits, and local commercial registries for business registration. The tax authorities determine corporate and individual tax obligations, making proper registration and compliance essential for legal and financial security.

Entity Structures in Mexico

Common business entities in Mexico include:

- Sociedad Anónima de Capital Variable (S.A. de C.V.) – A corporation suitable for medium to large enterprises. Legal entities are essential for complying with regulations and include various structures like corporations and limited liability companies.

- Sociedad de Responsabilidad Limitada (S. de R.L. de C.V.) – A limited liability structure, similar to an LLC. The Sociedad de Responsabilidad Limitada (S. de R.L. de C.V.) is a popular limited liability company structure, similar to an LLC.

- Sucursal (Branch Office) – Foreign companies can operate in Mexico but must register with authorities and meet capital requirements.

- Joint Ventures & Partnerships – Often used for entering regulated industries or forming strategic alliances.

Banking & Financial System in Mexico

Foreign businesses expanding into Mexico must establish a corporate bank account with a local financial institution. Leading banks include BBVA México, Banorte, Citibanamex, and Santander México, offering a range of financial services for businesses. Foreign exchange regulations are overseen by Banxico (Mexico’s Central Bank), ensuring currency stability and compliance with capital repatriation rules.

Labor Market & Employment Laws in Mexico

Mexico’s labor laws strongly favor employees, requiring businesses to provide mandatory severance pay, social security contributions, and paid vacation benefits. The Mexican Social Security Institute (IMSS) also plays a key role in supporting female employees during maternity leave, covering a portion of their salaries. Employers must navigate strict labor regulations to ensure compliance and avoid disputes.

Profit-Sharing (PTU) Requirements

Mexico mandates profit-sharing (PTU), requiring businesses to distribute 10% of taxable income to their employees annually. Additionally, minimum wage regulations continue to evolve, with different wage levels applied across various regions. Companies operating in Mexico must strategically manage compensation structures to maintain compliance and workforce stability.

Unions & Labor Relations

Unionized labor is prevalent, particularly in manufacturing and industrial sectors, making effective labor relations management essential for businesses. Companies must navigate collective bargaining agreements, labor negotiations, and employee rights to maintain operational efficiency and avoid labor disputes.

Technology & SAP Business One in Mexico

Mexico’s tech industry is rapidly growing, with strong advancements in fintech, e-commerce, AI, and digital transformation. Businesses across various industries rely on SAP Business One, a widely adopted ERP solution, to streamline financial management, operations, and regulatory compliance. Companies investing in digital infrastructure and automation gain a competitive edge in the evolving business landscape.

Cybersecurity & Data Protection in Mexico

Businesses operating in Mexico must comply with the Federal Law on Personal Data Protection (LFPDPPP) to ensure customer data security and regulatory compliance. With the rise of cyber threats, organizations must implement robust cybersecurity measures to protect sensitive information, maintain trust, and prevent data breaches in an increasingly digital economy.

International Taxation, Compliance & Tax Incentives

Mexico has a complex tax system with federal, state, and municipal taxes, including:

- Corporate Income Tax (ISR): 30%

- Value-Added Tax (IVA): 16% (0% for exports)

- Payroll Taxes: Varies by state (typically 2-3%)

- Tax incentives are available for manufacturing (IMMEX), technology investment, and export-oriented businesses.

Real Estate & Office Space in Mexico

Mexico’s top business hubs—Mexico City, Monterrey, Guadalajara, and Querétaro—offer prime office locations for companies looking to establish operations. Businesses can lease office space in corporate districts or choose flexible co-working spaces like WeWork for a cost-effective solution. While foreign investors can own property, restrictions apply within 50 km of borders and coastlines, requiring a Fideicomiso (trust structure) to legally acquire real estate.

Importing & Exporting in Mexico

Mexico has a well-regulated trade system, with customs and import regulations managed by SAT and the Ministry of Economy. Foreign investors seeking to own more than 49% of shipping companies engaged in high-seas traffic must obtain approval from the Commission for Foreign Investment. The IMMEX (Maquiladora) program provides tax benefits, allowing foreign manufacturers to import raw materials tax-free, provided the final products are exported.

Foreign Investment in Mexico

Mexico is one of the most attractive destinations for foreign direct investment (FDI) in Latin America, thanks to its strategic location, skilled workforce, and pro-business policies. The government encourages investment through special economic zones, tax incentives, and streamlined regulations in key industries such as manufacturing, technology, energy, and real estate. Foreign investors benefit from a stable economy, strong trade relations, and growing consumer demand, making Mexico a prime market for expansion and long-term business success.

Free Trade Agreements

Mexico has an extensive network of free trade agreements (FTAs) with over 50 countries, positioning it as a global trade leader. The United States-Mexico-Canada Agreement (USMCA) strengthens cross-border trade with the U.S. and Canada, offering duty-free exports and investment protections. Additionally, agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the European Union-Mexico Free Trade Agreement provide businesses with access to international markets, reducing tariffs and boosting trade efficiency.

Foreign Companies in Mexico

Many multinational corporations have established operations in Mexico, leveraging its cost-effective labor force, advanced manufacturing capabilities, and access to global markets. Companies in sectors like automotive, aerospace, electronics, fintech, and logistics thrive due to business-friendly policies and trade advantages. Foreign businesses must comply with local regulations, tax laws, and labor requirements, but with the right strategy, Mexico offers a highly profitable environment for international expansion.

Visas for Foreign Investors in Mexico

Mexico offers several visa options for foreign investors, entrepreneurs, and professionals looking to establish a presence in the country. The Temporary Resident Visa (Business Visa) is ideal for executives and investors managing business operations, while the Permanent Resident Visa suits long-term business owners and investors seeking to stay indefinitely. Work permits and Digital Nomad Visas also allow foreign professionals to legally reside and work in Mexico.

Mexico Business Culture & Practical Tips

Mexican Business Etiquette

Building relationships is fundamental to doing business in Mexico, where trust and personal connections play a key role in negotiations and decision-making. Meetings often begin with small talk and sometimes even a shot of tequila before transitioning into business discussions, reinforcing the importance of rapport. The corporate dress code is generally formal, but in sectors like tech, casual attire is more common.

Mexico Local Insights

Mexico’s economy is closely linked to U.S. trade policies and global market trends, influencing investment opportunities. Key business hubs include:

- Mexico City – The country’s financial and corporate center.

- Monterrey – A leading industrial and manufacturing hub.

- Guadalajara – Known as Mexico’s Silicon Valley, with a thriving tech sector.

Mexico City

As the largest city in Latin America, Mexico City serves as the economic, financial, and corporate hub of the country, attracting multinational companies and investors from around the world. Home to headquarters of major banks, global corporations, and government institutions, the city offers a highly developed infrastructure, top-tier business districts like Polanco and Santa Fe, and a thriving startup ecosystem. With a strong consumer market, world-class conference centers, and direct international connectivity, it is the prime destination for business expansion.

Top Business Hotels & Workspaces in Mexico

Mexico offers a range of luxury hotels in key business districts, including Ritz-Carlton, Four Seasons, and JW Marriott, providing premium amenities, business centers, and meeting facilities for corporate travelers. For those seeking flexible office solutions, co-working spaces like WeWork offer modern, fully equipped workspaces with high-speed internet and conference rooms, ensuring productivity and convenience for business professionals on the go.

Where to Have a Business Lunch?

Mexico is known for its world-class cuisine, making business lunches a great opportunity to strengthen relationships. Recommended restaurants in key business cities include:

- Mexico City: Pujol, Quintonil, and Biko.

- Monterrey: Pangea, Koli, and Grand Cru.

- Guadalajara: Alcalde, Bruna, and La Docena.

Interested in doing business in Mexico ?

Contacts

Our Offices

Our Blogs

Get started today!

It only takes a few moments to signup.