Cash Flow Management Explained: The Lifeblood of Your Business

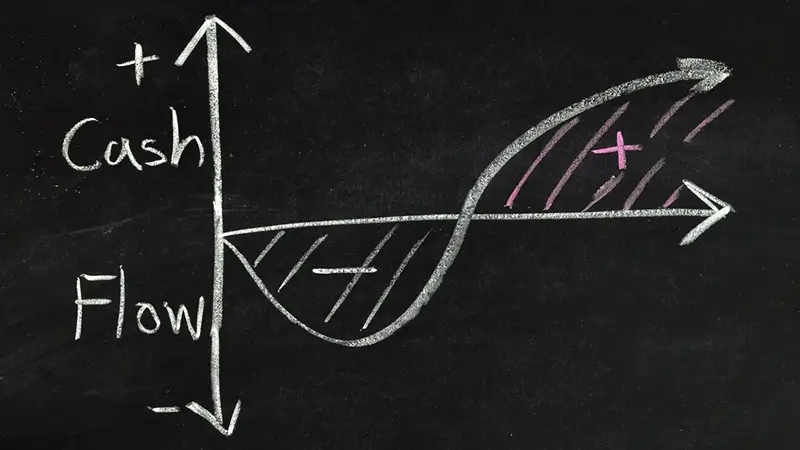

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

Quite often, the information at your disposal plays a significant role in helping you make the right business decisions. That partly explains why most entities spend much money yearly on management and data analytics software. Although quality data fosters effective decision-making, few entrepreneurs leverage the details that an annual business valuation provides.

Note that most organizations will consider a professional valuation only when they are part of an acquisition or a merger. That should not be the case since an annual business valuation can be an important process for businesses looking to track or benchmark their progress and those looking to grow. It can also precede a partnership or negotiation.

A professional conduct a valuation to provide an overview of your firm's marketplace competition, assets value, and income values. Publicly traded firms or companies with private investors can use an annual business valuation to demonstrate year-over-year growth. The bottom line here is that an annual business valuation can afford your entity several benefits. Before delving further into that, here are details on different business valuation approaches.

a) Market Approach

In business evaluation, the market approach focuses on similar businesses sold recently. For instance, if a seller owns a furniture manufacturer, an analyst will consider recent sales of other manufacturers within the same sector.

b) Asset-Based Approach

The difference between assets and liabilities is known as equity or book value. If you intend to sell all your business assets for cash and pay all your liabilities in cash, your company's equity will be the amount of money that remains. An analyst can calculate your firm's value using the fair value of assets and liabilities.

Including only those assets a business owns rather than those belonging to the founder is advisable in this case.

c) Income-Based Approach

The income-based approach focuses on a company's ability to generate cash inflows when calculating an entity's value. As such, an analyst will consider the expected cash flows that your business can generate in future years using this approach. The other metrics that the valuation can use to assess the value of your enterprise include earnings per share.

The sales of firms in the same industry should also be considered in the valuation.

Undoubtedly, most of the benefits of business valuations are in improving decision-making and business operations. However, an annual valuation of your entity is also important for reasons outside the confines of your organization. For example, a valuation will be necessary when considering estate planning, business succession, or if a divorce is imminent.

Understand that such critical life events demand proper valuation of your assets, and as an entrepreneur, your entity is an asset as well. An annual valuation of your enterprise gives you more clarity regarding its value, and it may be surprising to discover that it is one of your most important assets.

The process of estimating profitability, revenue, and expenses can be risky for your entity. The reason is that the resulting figures are not only ambiguous, but they provide insufficient insight into your business as well. Fortunately, a professional business valuation gives decision-makers accurate numbers and a realistic view of an entity's financial health.

Of course, concrete numbers are better than estimates, and entrepreneurs can use the data to make strategic changes. Leveraging an annual business valuation allows you to access pertinent details necessary for making important decisions about your organization.

Both small and large companies cannot overlook the importance of risk management. Although no two businesses are the same, entrepreneurs must prioritize making decisions that mitigate risk. In that case, opting to conduct an annual business valuation affords you important information on risk mitigation.

In turn, you will know your solvency ratio to determine whether taking on more debt is advisable or not, and you will also gain more clarity of your long-term, depreciating assets. In most cases, business risks are tied to financials. So, determining the accuracy of some financial areas of your enterprise can be a challenge without a proper valuation.

Additionally, determining how risk-averse you should operate going forward is possible using an annual business valuation.

Arriving at a price for your business is impossible if you lack insight into the market value. That means that you can avoid overvaluing or undervaluing your enterprise if you know what it is worth when you want to sell it. Also, it never hurts to gain insight into what your business is worth in the marketplace, even if you are not planning to sell it.

On the other hand, gaining a growth trajectory for planning for the future and more leverage in business dealings is possible when you know your entity's resale value. Remember that an accurate estimate of your enterprise's value in the current market is a requirement for mergers and acquisitions and is an ideal approach when strategizing for future business succession planning.

Knowing a firm's financial health with which you have a stake as an employee, investor, manager, or owner is not an option. So, if you want to assure your entity's stakeholders, conducting an annual business valuation is advisable.

The reason is that it is difficult for investors to trust their cash to a business that does not provide them with information about its financial stability and forecast to increase the commitment of stakeholders. Running a more transparent enterprise that will give your stakeholders more assurance is possible using an annual business valuation.

Conclusion

One of the essential yearly benchmarks of any successful enterprise is an annual business valuation. Also, it is safe to say that business valuations have a place in arranging the continuous activities of your organization. That is the case since the exercise offers an honest evaluation depending on the basics of your enterprise.

Comprehending the annual changes in the hidden essentials of your business will also prove worthwhile because it allows you to make necessary enhancements. So, if you have not conducted a business valuation in over a year, let's talk.

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

For global companies, matching intercompany transactions and pricing to the value created within their operations is key to both compliance and cost...

Expanding your business into international markets is an exciting opportunity, but it requires careful planning and a thorough understanding of the...