Expand your local business to new frontiers

International corporate secretarial services

Our corporate secretarial services meet the most demanding needs of international companies. We assist you through the challenges multinational companies face by easing your compliance burden and allowing you to focus on running your business.

Global Entity Incorporation

Providing an integral solution for entry and operations within international markets

Read More

Global Director

Services

Support to handle all your commercial, administrative, and banking necessities

Read More

Global Document

Retrieval

Documents available through our network of experts make the process faster and more reliable

Read More

Why choose H&CO

Entity Management Service?

H&CO offers comprehensive global corporate compliance management through Entity Management.

Our multidisciplinary approach integrates tax, consulting, accounting, and financial advisory to deliver streamlined, cost-effective services.

With expertise in complex compliance and value-added services, we ensure consistent global coordination across 16+ countries to guide your project efficiently.

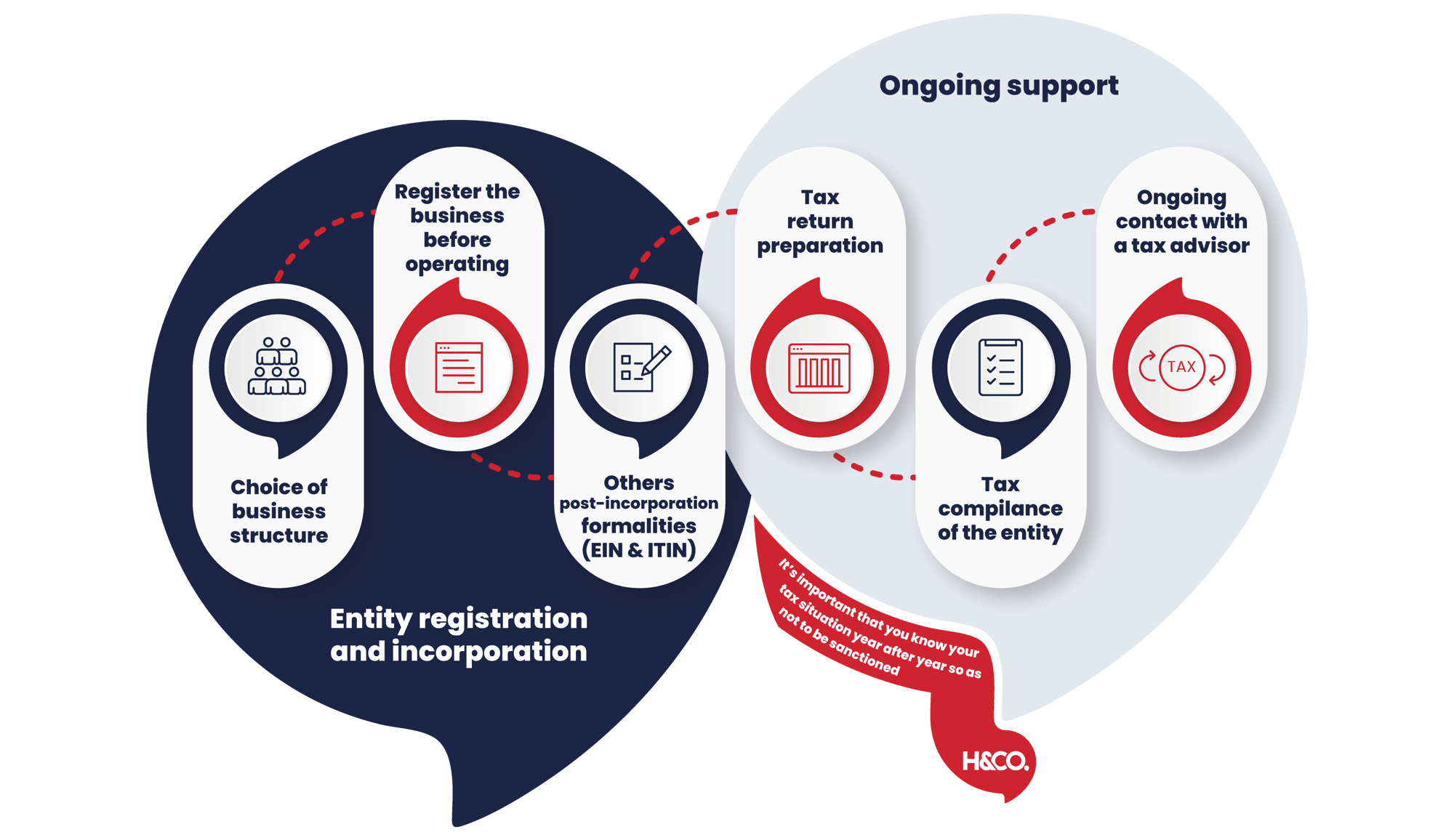

Our International Corporate Secretarial

Services include:

Business Entity Incorporation

Starting a business in a foreign jurisdiction is never a simple matter. Obligations, procedures, deadlines, language barriers, and costs vary widely from country to country and sometimes between cities and states.

Having advice from a trusted professional is essential in this first stage where the operability of a company must be established and cover all tax compliance Incorporation is the way a company is formally organized and officially created.

The assets and cash flows of the commercial entity are kept separate from those of the owners and investors, which is called limited liability.

- Protects the owner's assets against the liabilities of the company.

- Allows easy transfer of ownership to another party.

- Often gets a lower tax rate than personal income.

- Generally receives more lenient tax restrictions on loss carryforwards.

- Can raise capital through the sale of shares

Here are some key tips you should keep in mind

-

If you have a company in the United States, you must pay taxes

As a business owner, it is important to understand your federal, state, and local tax requirements.

This will allow you to file your tax returns correctly and make your payments on time.

The business structure you choose when starting a business will determine what taxes you must pay and how to pay them.

-

Tax return to be filed by an American company

Most businesses must file and pay federal taxes on any income received during the year. LLC limited liability companies with two or more shareholders (Partnership) or a single foreign owner (“DRE”).

However, they must file an annual information return (in English) but do not pay income tax. On the other hand, each partner reports his share of the profit or loss on his individual tax return.

Almost all states impose income tax or income tax on corporations and businesses. However, each state and locality have its own tax laws.