New Accounting Standards Upcoming Effective Dates for Private Company

In this publication, we’ve summarized the new standards that take effect in annual 2021 financial statements for nonpublic entities. Those effective...

Understanding how to navigate the numbers in a company's financial statements is a crucial skill for stock investors. Analyzing and interpreting balance sheets, income statements, and cash flow statements to uncover a company's investment potential forms the foundation for making wise investment decisions.

Continue reading as we explore in detail the contents and scope of a company's financial statements, as well as the crucial information investors need to be aware of.

| Table of Contents |

Financial statements are formal records that provide information about the financial activities and performance of a business, person, or other entity. They are essential tools for understanding the financial health of a company and are used by investors, creditors, lenders, and management to make informed decisions.

Financial statements are prepared per accounting standards, such as Generally Accepted Accounting Principles (GAAP) in the United States or International Financial Reporting Standards (IFRS) in many other countries. This ensures that they are consistent and comparable, which allows users to compare the financial performance of different companies.

Furthermore, it is important to note that in addition to the four main types of financial statements, there may be other industry or company-specific financial statements. For instance, a bank might prepare a statement of changes in capital, which provides insights into how the bank's capital has evolved over a while.

1. Balance Sheet: presents a snapshot of a company's financial position at a specific point in time, typically the end of a quarter or year. It provides a comprehensive overview of the company's assets, liabilities, and shareholders' equity, giving investors a clear understanding of its financial standing. Think of it as a snapshot that captures the company's financial health and helps investors gauge its overall stability and worth.

2. Income Statement: This section focuses on a company's profitability over a specific period, typically a quarter or year. It provides an overview of how the company generated revenue, incurred expenses, and ultimately arrived at its net income (profit or loss). Think of it as a concise summary that highlights the company's financial performance during that time.

3. Cash Flow Statement: This tracks the movement of cash into and out of a company over a period. It's broken down into three sections: operating activities (cash related to core business operations), investing activities (cash used for buying or selling assets), and financing activities (cash raised or used for debt and equity). This statement helps understand how the company manages its cash flow, which is crucial for its survival.

4. Statement of Retained Earnings: This section explains how a company's profits have been accumulated or distributed over time. It begins with the initial balance of retained earnings (profits retained by the company), adds the net income for the period, and subtracts any dividends paid to shareholders. The resulting balance indicates the amount of profit that the company has retained for future reinvestment or distribution.

The primary objective of conducting financial statement analysis is to assess a company's performance and value based on its balance sheet, income statement, and statement of cash flows. By employing various techniques, such as horizontal, vertical, or ratio analysis, investors can gain a more comprehensive understanding of a company's financial standing. These methods allow for a more nuanced evaluation of the company's financial profile.

Financial analysts commonly employ three primary techniques to analyze a company's financial statements.

Firstly, horizontal analysis involves comparing historical data. The purpose of this analysis is typically to identify growth trends across different periods.

Secondly, vertical analysis compares items on a financial statement to one another. For example, an expense item could be expressed as a percentage of company sales.

Lastly, ratio analysis, which is a central component of fundamental equity analysis, compares line-item data. Examples of ratio analysis include price-to-earnings (P/E) ratios, earnings per share, and dividend yield.

According to Harvard Business School, a financial statement should be read in the following manner:

The balance sheet is a valuable tool that portrays the "book value" of a company. It offers insights into the company's available resources and how they were financed as of a specific date. It presents a breakdown of the company's assets, liabilities, and owners' equity, which essentially represent what the company owes, owns, and the amount of investment made by shareholders.

Moreover, the balance sheet provides crucial information that can be utilized to calculate rates of return and evaluate the company's capital structure, using the accounting equation:

Assets = Liabilities + Owners' Equity.

The income statement, also referred to as a profit and loss (P&L) statement, provides a comprehensive overview of the financial impact of revenue, gains, expenses, and losses during a specific period. It is typically included in quarterly and annual reports and offers valuable insights into financial trends, business activities (such as revenue and expenses), and comparisons over designated periods.

Accountants, investors, and other business professionals frequently analyze income statements to determine the financial health of their company. They use this data to understand profitability, calculate the cost of production, and identify the cash available to invest back into the business. Additionally, analyzing income statements helps in identifying the financial trends such as when costs are highest and when they are lowest.

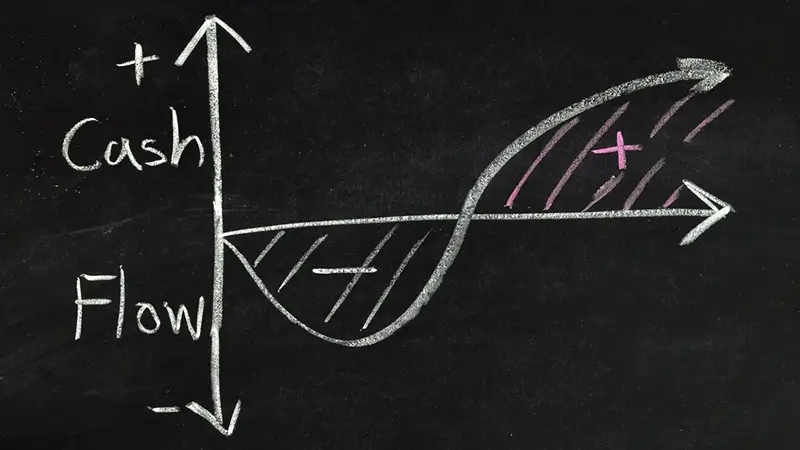

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified duration of time, known as the accounting period. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of it.

Cash flow statements are broken into three sections: Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. Investing activity is cash flow from purchasing or selling assets—usually in the form of physical property, such as real estate or vehicles, and non-physical property, like patents—using free cash, not debt. Financing activities detail cash flow from both debt and equity financing.

It is crucial to understand the distinction between cash flow and profit. Cash flow refers to the actual cash that is entering and leaving a company, while profit is what remains after deducting all expenses from revenues. Both of these numbers are essential to consider.

An annual report is a publication that public corporations are required to publish annually to shareholders. It serves to provide a comprehensive overview of the company's operational and financial conditions.

In addition to financial statements such as the income statement, balance sheet, and cash flow statement, annual reports often include editorial content, such as images, infographics, and a CEO letter.

This editorial content helps to describe corporate activities, benchmarks, and achievements and provides investors, shareholders, and employees with a deeper understanding of the company's mission and goals. Furthermore, annual reports also offer industry insights, management's discussion and analysis (MD&A), accounting policies, and additional investor information.

Alongside annual reports, public companies in the United States are required by the US Securities and Exchange Commission (SEC) to produce a more detailed 10-K report.

The 10-K report provides in-depth information on a company's financial status, including fiscal activity, corporate agreements, risks, opportunities, current operations, executive compensation, and market activity. It also includes detailed discussions of operations for the year and a comprehensive analysis of the industry and marketplace.

At H&CO, our experienced team of tax professionals understands the complexities of income tax preparation and is dedicated to guiding you through the process. With offices in Miami, Coral Gables, Aventura, Tampa, and Fort Lauderdale, our CPAs are readily available to assist you with all your income tax planning and tax preparation needs.

To learn more about our accounting firm services take a look at our individual tax services, business tax services, international tax services, expatriate tax services, SAP Business One, entity management, human capital, and audit and assurance services.

In this publication, we’ve summarized the new standards that take effect in annual 2021 financial statements for nonpublic entities. Those effective...

Cash flow management is a fundamental process that involves tracking, analyzing, and controlling the financial transactions occurring within your...

The Internal Revenue Service announced the beginning of the nation's 2023 tax season when the agency will begin accepting and processing 2022 tax...